May 31, 2018

Momentum can be a fickle gift (aka “No, it’s never different this time”)

Market cycles end when the collective delusion of risklessness disappears. Protracted periods of gently rising markets and low volatility encourages investors into believing that the low-risk environment is permanent (“It’s different this time”) – and so discourage critical thought and care. When the source of market returns is concentrated in a sector or sectors, the cycle’s end is punctuated with a mania, peak, and collapse.

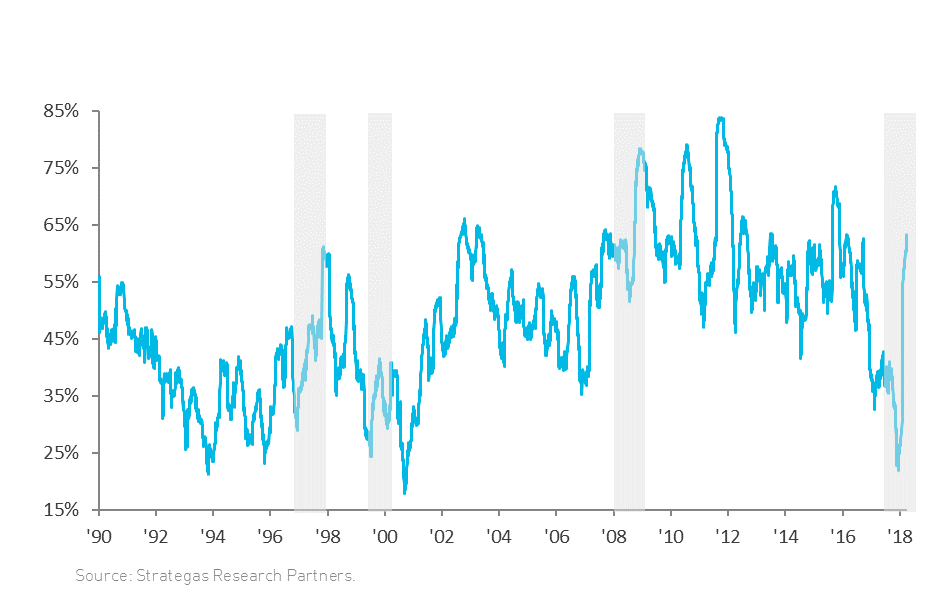

One of the markers of the end of a market cycle is that volatility returns, and in the midst of that volatility, stocks trade more in lock step with one another (their returns are more “highly correlated”). In Figure 1 below, you can see the correlation line bounce straight up from the lows of 1997, 2000, and 2008 as those markets accelerated into market peaks, and then corrected. In these periods, investors were quickly swept from “optimistic” to “greedy,” and then to “fearful” and as they began indiscriminately selling stock across their portfolios to get into safer options like bonds or cash. In 2018, a flat market return for the first quarter masked a huge rise in volatility and in the midst of that, correlations among stocks similarly spiked.

Figure 1: Rolling 65-day correlations of S&P 500 stocks, January 1990 - March 2018

Since the turn of this century, we’ve had two major corrections. In 1999-2000, investors bid up Technology stocks based on the premise that the Internet would transform commerce and that every company associated with that revolution would mint cash. This proved only partially true, of course, as the earnings followed but only much later and only for a select few. But in the midst of the frenzy, deluded investors scrambled to place their bets based on valuations tied to subscribers, or impressions or at best, revenues – but not earnings. More on them later.

The 2008 credit crisis popped a massive delusion of the free lunch. Investors (and indeed the most sophisticated ones – the banks themselves) uncritically bought securities that advertised fat yields for risk-free exposures – and discovered too late that they owned worthless paper. On the way up, broker dealers sold their clients the myth, sadly often unaware of the error they themselves believed.

I had a conversation recently with Matt Egenes, client portfolio manager with Barrow, Hanley, Mewhinney & Strauss (BH). BH is the second-largest manager of active U.S. value equities in America[1], and the team there manages large- and mid-capitalization value and dividend-focused U.S. equity portfolios for Leith Wheeler clients.

Egenes is somewhat circumspect when comparing the current environment to these past ones. He doesn’t detect an institutional-level fraud being committed on the market. And even the Technology comparison, while tempting given the way that Facebook, Amazon, Netflix, and Google (the FANG stocks) have dominated U.S. equity market returns, requires some qualification.

“FANG stocks began to outperform and drive growth in 2015, but since then it's become a broader phenomenon that has spread,” Egenes says. “In addition to Facebook and Google other growth stocks like MasterCard and Visa and Adobe and some of the others that are tech-oriented have spiked, so it's not just been the big four.”

Unlike in the dotcom era, the growth companies driving index returns this cycle generally earn profits, but the valuations for certain of the FANGs are still rich. He points to Amazon as an example of such a company that is still a distance from fair value with its 129x forward P/E multiple.

“Even after its recent earnings surprise, Amazon would still need to grow its earnings at a compounded rate of 50% per year over the next five years for it to trade at a market multiple. That’s something they’ve never done in the history of the company,” he says. “So you're paying a significantly higher valuation for marginally more earnings. That’s just not sustainable.”

We are not calling for a market collapse as there are plenty of data points (developed in this piece a few months back) that support the notion that economic growth could carry us for some time yet. But there appear to be a few more clouds on the horizon – increasing market concentration, higher correlation of returns, and bloated-but-rationalized valuations – that should cause investors to be more wary and defensive in the months to come.

[1] Source: Pensions & Investments May 29, 2017, based on U.S. institutional, tax-exempt assets as of December 31, 2016.

Recent Posts

- VIDEO: Navigating Dementia: Recognize, Prepare, Plan

- New Trust Reporting Requirements Now in Effect May Catch Some by Surprise

- Leith Wheeler Explainer Series: The Dividend Debate

- Hitting Pay Dirt: The Selling of an Ag Empire

- The Risks of Transactive Memory

- Building Out Your Core with US SMID and Emerging Markets Equities

- Resources for Reconciliation - 2023

- How Could Budget 2023’s Proposed Taxation of Donated Securities Affect Not-for-Profits?

- Taming an Unintentional Portfolio

- Women, Money, and My Holiday Beach Read