September 10, 2018

Leith Wheeler High Yield Bond Fund Tops Canadian Charts Through Three Years

At Leith Wheeler, it’s not really in our nature to talk about ourselves so when we do something well, unless you’re a client reading your statement, you’re unlikely to hear about it.

That said, as we marked the important three-year milestone for the Leith Wheeler High Yield Bond Fund (HYBF) this summer and tallied the results, we had to do some soul searching. The thing is, the results have been pretty good. And not just low-expectations “expansion team” good, like the Washington Capitals’ 8 win - 67 loss inaugural season. More like Vegas Golden Knights good.

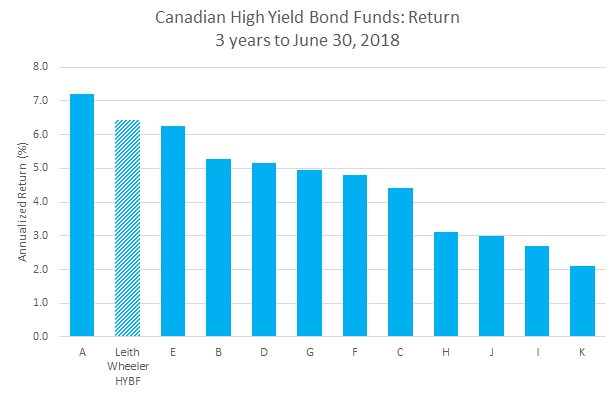

The annualized three-year return for the HYBF was 6.44% per year through June, high enough to rank second in our Canadian high yield peer group (defined as Canadian-domiciled, long-only funds focused on investment in high yield bonds).

Source: eVestment. Three-year annualized pre-fee returns for period ended June 30, 2018 for Leith Wheeler High Yield Bond Fund (CAD Hedged) and Canadian high yield bond funds with similar mandates.

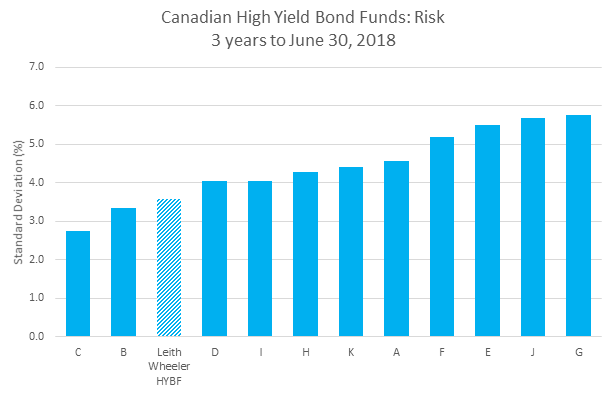

Importantly, though, we achieved it with one of the group’s lowest risk profiles.

Source: eVestment. Risk measured as standard deviation of returns over three-year period ended June 30, 2018 for Leith Wheeler High Yield Bond Fund (CAD Hedged) and Canadian high yield bond funds with similar mandates.

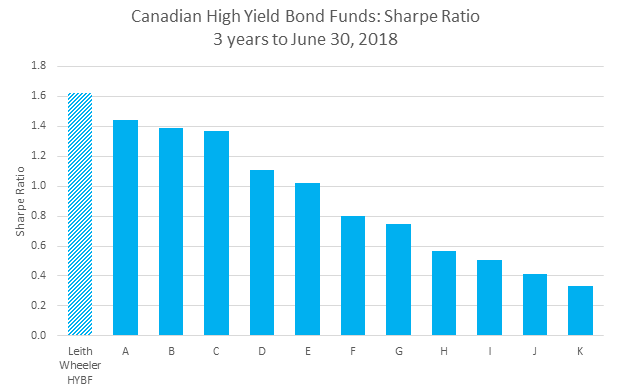

Put those together, and the Leith Wheeler High Yield Bond Fund actually had the best risk-adjusted returns in the country for the past three years. Investors reference the “Sharpe Ratio” as shorthand for measuring this risk-return concept. The Sharpe Ratio compares the return on a fund to what an investor could earn on a risk-free investment like a government bond, and then divides by the amount of volatility (or “standard deviation of returns”) that the investor experiences over the period.

Sharpe Ratio = Fund Return – Risk-free Return

Standard Deviation of Returns

Portfolio theory suggests that more risk should generate more return. And more return should require more risk be taken. Funds with higher Sharpe Ratios thus earn better returns, incur less risk, or both. As it happens, the measured way our bond team invested across a variety of strategies in the fund since its inception has helped our clients achieve the best of both worlds.

Source: eVestment. Sharpe ratios for three-year period ended June 30, 2018 for Leith Wheeler High Yield Bond Fund (CAD Hedged) and Canadian high yield bond funds with similar mandates.

In addition to the HYBF proving to be an “efficient” fund in terms of risk-for-return, the fund itself helps Leith Wheeler clients achieve important diversification benefits within their broader portfolios – both in terms of credit, and geographic exposure through its ownership of US issues. It was also introduced to leverage the talents of our bond team and to offer clients enhanced yield options in a low-yield environment.

For Jim Gilliland, President, CEO, and Head of Fixed Income, it is encouraging to see the firm’s investment in the fixed income and analytics teams yielding results. “We have been very deliberate in building up our fixed income capabilities over the last nine years,” he said. “Like everything at Leith Wheeler, the addition of talent and technology has been built on a commitment to strict investment discipline, and a courage of our convictions to ‘look different’ from the market when opportunities arise.”

HYBF manager Dhruv Mallick, who oversees the HYBF as well as the Multi Credit Fund (which opportunistically invests in high yield and investment grade corporate bonds, and senior loans) points to one of the key differentiators for the Leith Wheeler approach.

“A typical high yield strategy might have hundreds of names, but we try to build portfolios with only a few names and a focus on risk-adjusted returns, much as a stock picker would,” he said. He added that the team couldn’t have achieved the results they did without the firm’s investment in risk systems, screening tools and technology, and the cross-asset investment discipline in which both bond and equity analysts help identify and vet investment ideas together.

At Leith Wheeler, we’ll keep doing what we’ve been doing for clients since 1982 – and while we’re well aware that three years isn’t 36, in many ways, we believe it reflects that legacy. And in our humble view, it is a pretty good start.

By Mike Wallberg, CFA, MJ | Leith Wheeler Vice President, Marketing & Communications

Recent Posts

- VIDEO: Navigating Dementia: Recognize, Prepare, Plan

- New Trust Reporting Requirements Now in Effect May Catch Some by Surprise

- Leith Wheeler Explainer Series: The Dividend Debate

- Hitting Pay Dirt: The Selling of an Ag Empire

- The Risks of Transactive Memory

- Building Out Your Core with US SMID and Emerging Markets Equities

- Resources for Reconciliation - 2023

- How Could Budget 2023’s Proposed Taxation of Donated Securities Affect Not-for-Profits?

- Taming an Unintentional Portfolio

- Women, Money, and My Holiday Beach Read