February 19, 2018

The Retirement You Can Expect from Your Current RRSP Contribution Plan

It’s particularly busy around the halls of Leith Wheeler each February as our clients scramble to beat the RRSP contribution deadline, this year on March 1, 2018. During the frenzy, we are glad for the opportunity to talk about portfolio strategy and offer advice on how to maximize the potential for a comfortable retirement.

We’ve written in this blog about strategies for RRSP and TFSA investing by life stage before. But we’re aware that the echoing refrain of “Maximize your contributions … butions … butions…” is in your newspaper, your inbox, your bus shelter again this year. So we thought we’d add some value to the mantra by putting some numbers around what maximizing your RRSP contribution room could actually look like for your retirement, depending on when you start saving, and how much.

The following charts illustrate a few scenarios for investing before age 65. Note that these results rely on the assumptions below, and aren’t a guarantee of market returns!

The assumptions we used:

- Salary at age 30 of $55,000, and growing annually thereafter at 3.6% per annum, the top end of Canada’s wage growth bands over the last 20 years. Age 65 income of $190,000, which may look high but remember, this would be in the year 2053. In 2018 dollars, the equivalent salary (adjusted for 2% annual inflation) would be about $95,000 in the last year of work.

- Annual “RRSP maximum” determined as the lesser of 18% of annual previous-year income and the policy maximum. 2017 policy maximum of $26,010 is increased at 2.2% per year going forward – in line with the average increase over the last 5 years. Age 65 policy maximum of $66,302.

- Portfolio returns of 6% per annum, representing a largely equity-weighted asset mix throughout (with an assumption of 7% annual total returns from equity markets over time).

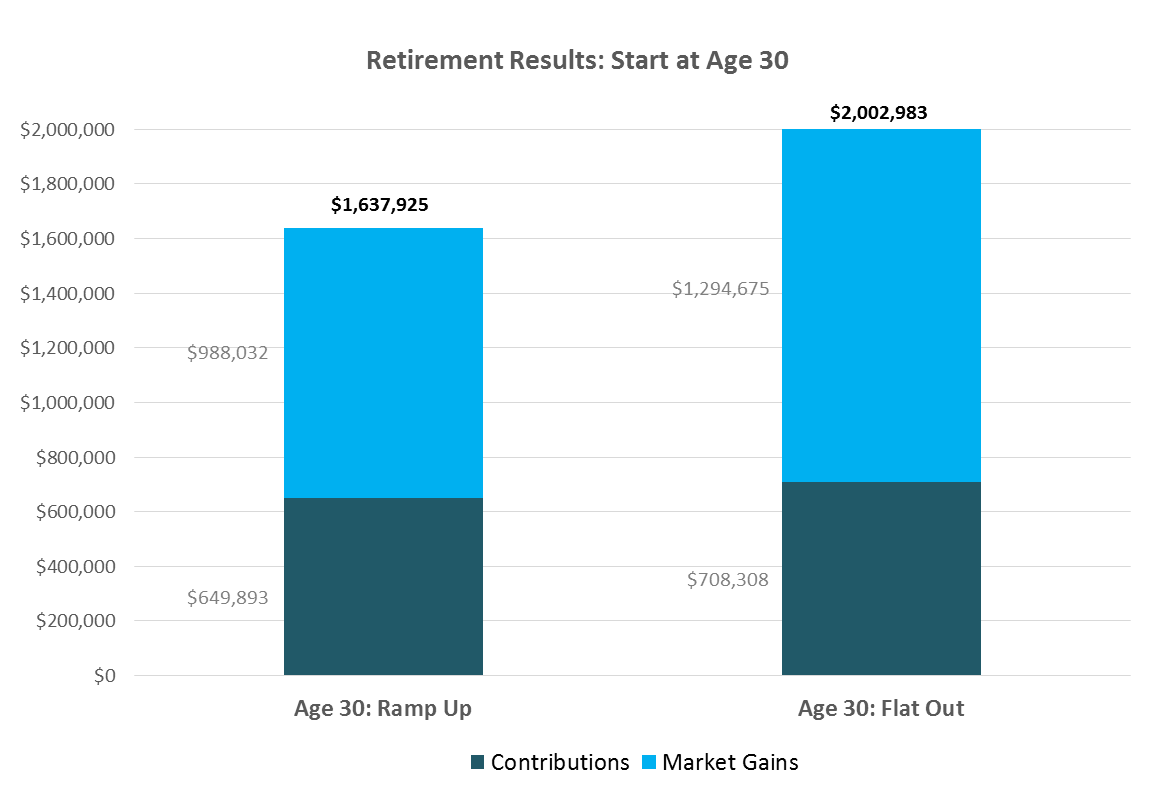

Scenario 1 assumes you start contributing to your RRSP at age 30. The accompanying Chart 1 below shows what would happen if you contributed half of your maximum allowable room for a ten-year period (until 40), and then “ramped” up to 100% for the remaining 25 years. It then compares that result to your retirement pot if you found a way to max your contribution to 100% of allowable for all 35 years, including the actual dollars invested and the compounding effect on those earlier contributions.

The key takeaway from this scenario is that an incremental investment of $60,000 while in your 30s would add over $300,000 in additional compounded returns by retirement time, resulting in a total retirement fund of $2.0 million (flat out scenario) versus $1.6 million (ramp up scenario).

Chart 1: Retirement scenarios for starting RRSP contributions at age 30

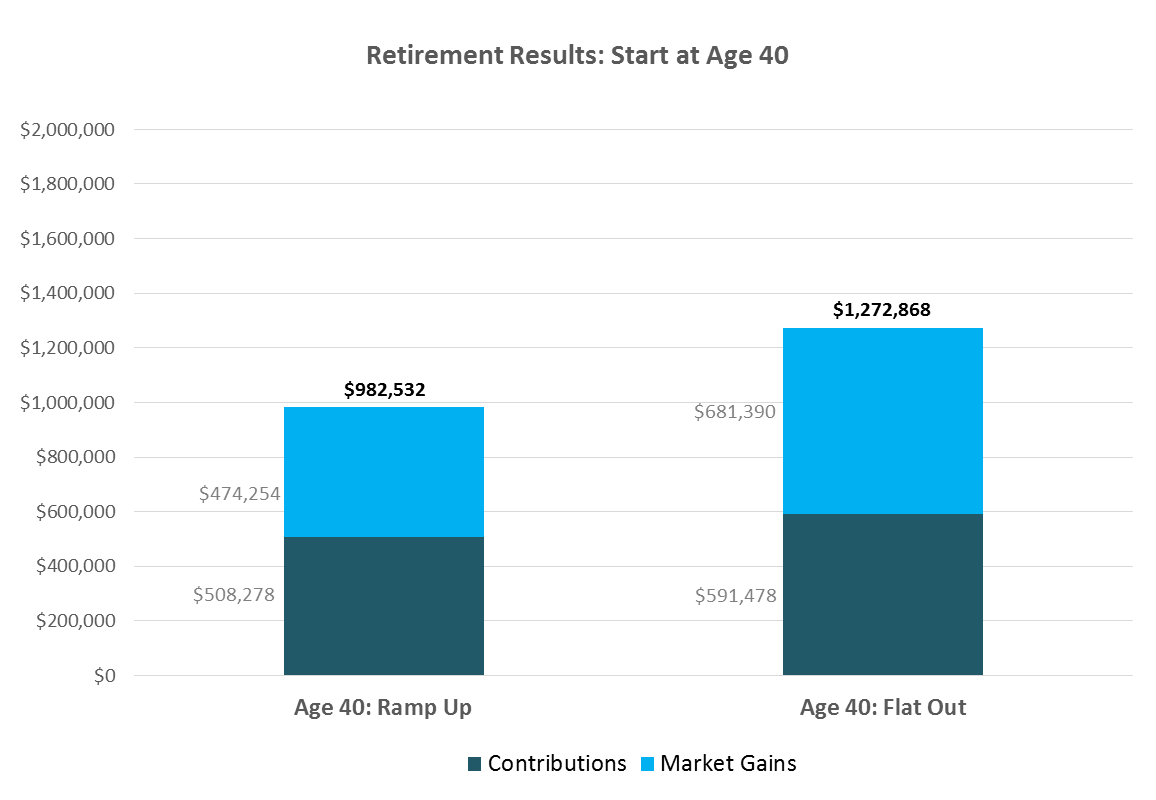

Scenario 2 assumes you start at age 40. The accompanying Chart 2 below shows what would happen if you contributed half of your maximum allowable room for a ten-year period (until 50), and then “ramped” up to 100% for the remaining 15 years. It then compares that result to your retirement pot if you found a way to maximize your contribution to 100% of allowable for all 25 years, including the actual dollars invested and the compounding effect on those earlier contributions.

The key takeaway from this scenario is that an incremental investment of $80,000 while in your 40s would add over $200,000 in additional compounded returns by retirement time. The later start means lower totals across the board: a total retirement fund of $1.3 million (flat out 40 scenario) versus just under $1.0 million (ramp up 40 scenario).

Chart 2: Retirement scenarios for starting RRSP contributions at age 40

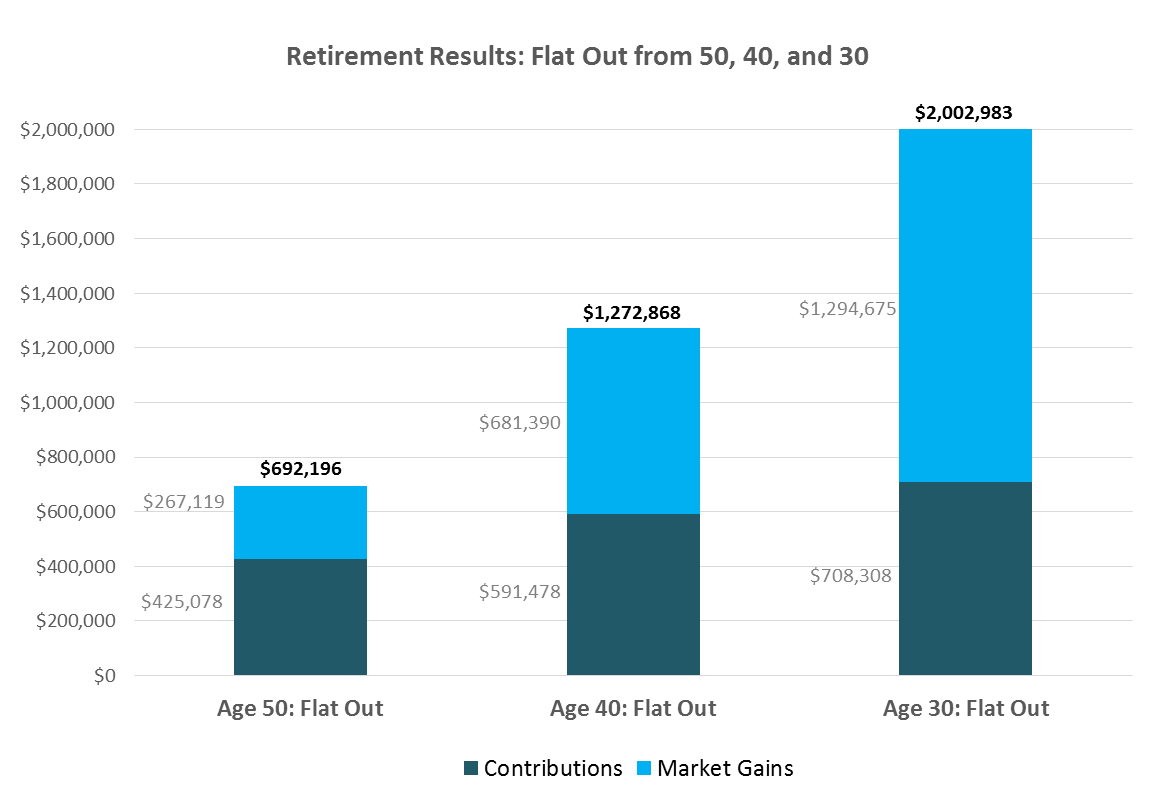

Scenario 3 shows the incremental impact of maximizing RRSP contributions from age 30 (35 years), age 40 (25 years), and age 50 (15 years). It also shows the incremental dollars invested by decade, and the compounding effect on those earlier contributions through age 65. The results are in Chart 3 below.

The key takeaways from this scenario are that starting early and maximizing contributions can have a material impact on retirement savings:

- Starting at age 50 and making the maximum contribution for the next 15 years would result in just under $700,000 for retirement, with $425,000 of that coming from your own contributions and only $265,000 from the market.

- Starting 10 years earlier would mean contributing $165,000 more in your 40s, but markets would add another $415,000 to that amount – to take retirement savings to $1.3 million.

- Again, the best-case scenario is maximizing from age 30 onward. Even those 10 years of contributions in your 30s – totaling $120,000 – would compound up to an additional $600,000 in market gains by retirement – an amount nearly equivalent to all the gains from contributions after age 40, all tax-free. Total retirement fund at age 65: $2.0 million.

Chart 3: Retirement result scenarios for investing starting at ages 50, 40, or 30

We know that it may not always be possible to squirrel away every nickel for retirement. But hopefully this exercise illustrates the power of getting in as early as possible and with as much as you can afford. The compounding power of being invested over time can have a material impact on both your fund balance at retirement, and the kind of retirement you can then enjoy.

Recent Posts

- VIDEO: Navigating Dementia: Recognize, Prepare, Plan

- New Trust Reporting Requirements Now in Effect May Catch Some by Surprise

- Leith Wheeler Explainer Series: The Dividend Debate

- Hitting Pay Dirt: The Selling of an Ag Empire

- The Risks of Transactive Memory

- Building Out Your Core with US SMID and Emerging Markets Equities

- Resources for Reconciliation - 2023

- How Could Budget 2023’s Proposed Taxation of Donated Securities Affect Not-for-Profits?

- Taming an Unintentional Portfolio

- Women, Money, and My Holiday Beach Read