December 09, 2020

2020 Distributions

It’s December, which means that fund investors in taxable accounts will be turning their focus to upcoming distributions. To help decipher what that means in general – as well as for Leith Wheeler Series B funds in particular – we’ve provided a bit of a refresher below, along with a table of estimated figures for 2020.

Anatomy of a distribution

Funds have two sources of return that the CRA taxes: income and realized capital gains. Income represents the dividends paid out by shares held in a fund, plus any interest received from bonds or other short-term securities.

Realized capital gains represent the gain locked in when we sell a security for more than we paid for it (or loss if we exit below our original cost). These gains and losses from the year are netted out against one another and the net gain is then “distributed” to clients, which is taxable. Income distributions tend to be issued monthly or quarterly and capital gains distributions annually, at this time of year.

Gains are realized when we trim or sell positions when they become overvalued or our outlook changes. While there is not necessarily a relationship between fund performance and distributions in any given year, over time investors should expect to receive them as a marker that progress has been made in growing their investments. One of the benefits of investing with us is that our long-view investment style naturally gives rise to lower distributions in any given year – because we tend to buy and hold for longer periods and therefore don’t trade as often, we tend to trigger relatively fewer realized capital gains from year to year.

How it works

You may notice that when a distribution happens in a fund, the fund’s unit price dips. This dip is the exact amount of the distribution. Because that gain has now effectively been taxed in the hands of unitholders, the price for new buyers of the fund lowers. For this reason, you will see the unit prices for all of our funds with distributions fall slightly on the date of payment. Don’t be alarmed; you receive a commensurate number of units via the distribution, so your overall market value is unaffected!

An example

Say you hold 10 units of Mutual Fund ABC, which has a net asset value (NAV, or price) on the close of business on December 21 of $10. You therefore hold $100 of ABC Fund. The fund then distributes $0.20 of capital gains to unitholders, so when you check the value online as of the close, ABC’s NAV shows $9.80, not $10. You still have $100 worth of ABC, however, as your units have been automatically increased from 10 to 10.2041. Nine eighty times 10.2041 = $100. Presto!

Leith Wheeler 2020 estimated fund distributions

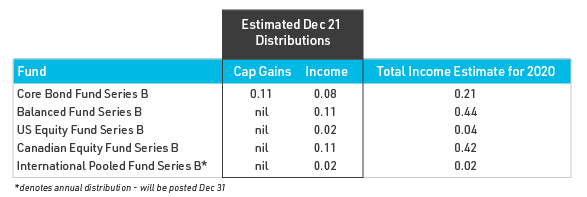

A quick reminder that select Leith Wheeler funds pay applicable capital gains and income distributions in December (they will be posted either December 21st or December 31st this year, depending on the fund). The estimated distributions are as follows, but please note that these are estimates only and are subject to change.

Thank you!

As we head into the final stretch of a very tough year, we at Leith Wheeler are so grateful for the relationships we enjoy with our clients and community partners. We thank you for your continued trust and support and wish you and your loved ones a healthy and safe 2021. Happy holidays!

Recent Posts

- VIDEO: Navigating Dementia: Recognize, Prepare, Plan

- New Trust Reporting Requirements Now in Effect May Catch Some by Surprise

- Leith Wheeler Explainer Series: The Dividend Debate

- Hitting Pay Dirt: The Selling of an Ag Empire

- The Risks of Transactive Memory

- Building Out Your Core with US SMID and Emerging Markets Equities

- Resources for Reconciliation - 2023

- How Could Budget 2023’s Proposed Taxation of Donated Securities Affect Not-for-Profits?

- Taming an Unintentional Portfolio

- Women, Money, and My Holiday Beach Read