March 09, 2016

Assessing the Risks of a Recession

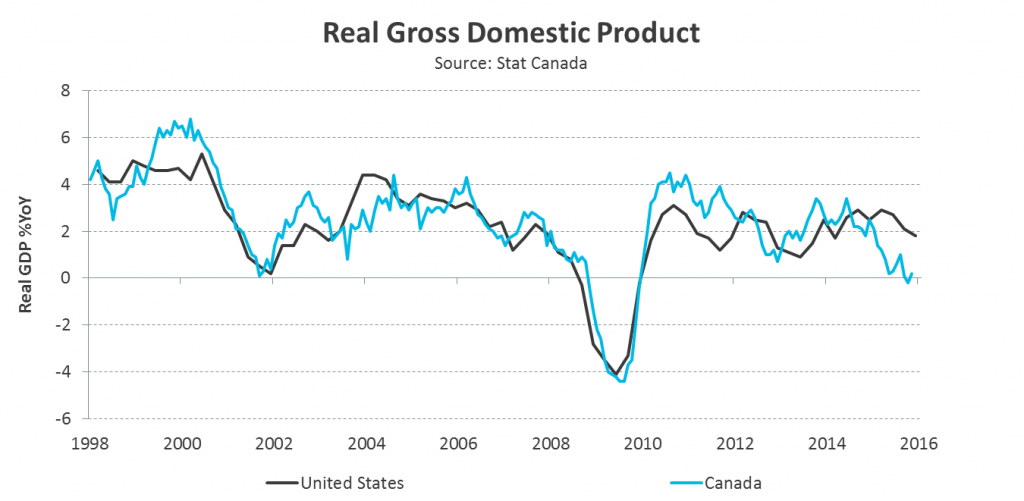

Canada was not in recession in early 2015, and never has been without a U.S. recession.

- Indicators of a U.S. recession are rising, namely yield curve flattening and tightening lending standards...

- ...but these signals are inconclusive given other macro-economic indicators.

- Our base case scenario is that both countries avoid recession, but the risks in Canada are higher.

What is a Recession?

The definition of recession is an often misunderstood concept in economics.

In a 1979 New York Times article1, economic statistician Julius Shiskin suggested several rules of thumb for defining a recession, one of which was two consecutive quarters of contracting Gross Domestic Product (GDP).

In the United States, the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER) is generally seen as the authority for dating U.S. recessions. The NBER defines an economic recession as:

"A significant decline in economic activity spread across the economy, lasting more than a few months, normally visible real GDP, real income, employment, industrial production, and wholesale-retail sales."2

The NBER committee's procedure for identifying turning points differs fromthe two-quarter rule in a number of ways. First, they do not identify economic activity solely with real GDP and real GDI, but use a range of other indicators. Second, they place considerable emphasis on monthly indicators in arriving at a monthly chronology. Third, they consider the depth of the decline in economic activity.

Was Canada in a Recession in 2015?

In Canada, the unofficial arbiter of recession is the Business Cycle Council, an arm of C.D. Howe Institute think tank made up of seven private sector economists. They have publicly stated that there was no evidence that Canada's economy has slipped into recession during 2015 in any of the ways typically associated with the term.

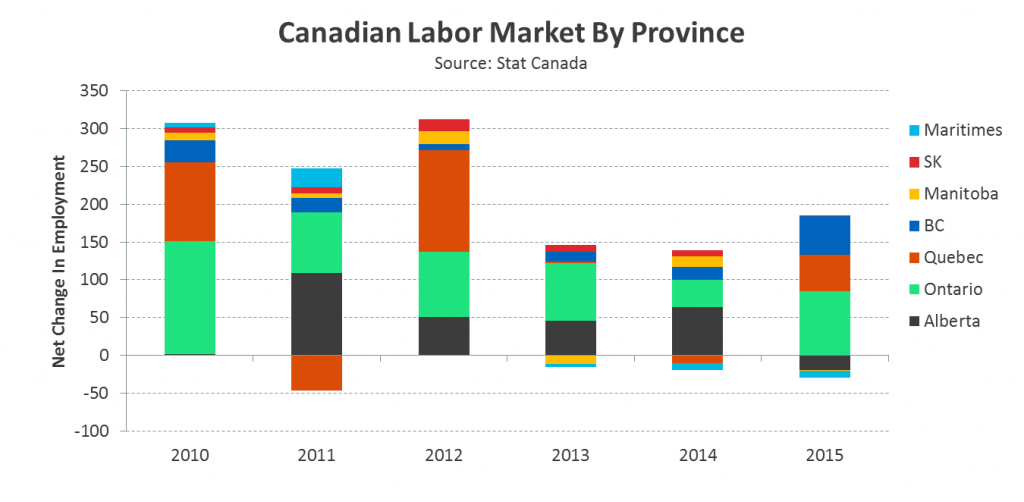

For instance, an example of an indicator that is frequently used to determine whether an economy is in recession is the labour market. During 2001, both the U.S. and Canadian economies slowed but only the United States economy entered recession.

Part of the explanation for this can be seen in the stark difference between the United States and Canadian labour markets during this time. While the United States experienced net job losses in 2001 and 2002, the Canadian labour market surged with 2002 in particular being the strongest recorded labour market growth on record.

Similarly, Canadian labour market growth in 2015 was the strongest in three years. Lower oil prices clearly weighed on jobs in Alberta, which had contributed significantly to employment growth between 2011 and 2014. However, this was more than offset by improving employment growth in Ontario, British Columbia, and also notably in Quebec which added a material number of jobs in 2015 for the first time in three years.

Forward-Looking Recession Indicators

Unfortunately, labour market indicators are frequently considered a lagging economic indicator. They do not provide a particularly timely or forward-looking indication of the state of the economy, making their use as a predictor of recession limited.

There are, however, several economic and market-based indicators which have historically been useful indicators of the probability of recession.

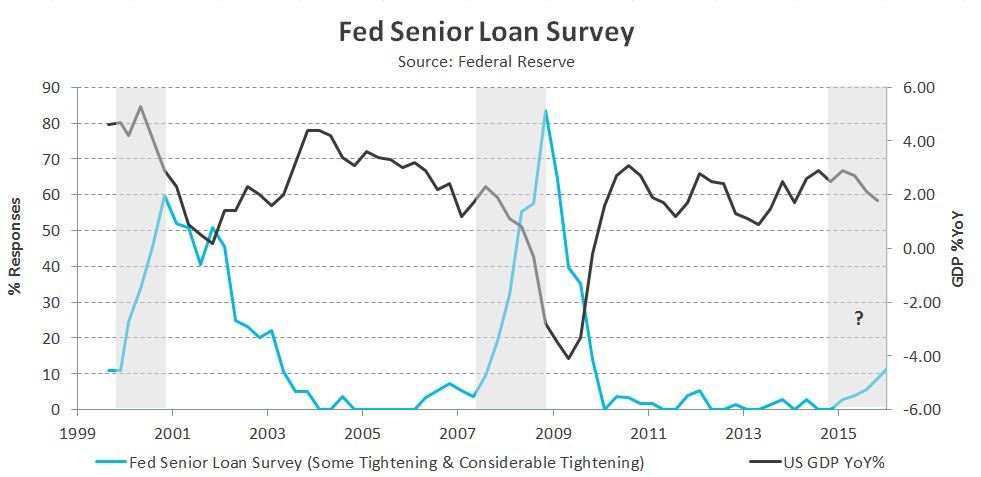

One such indicator has been a tightening in credit conditions. In the United States, the Federal Reserve’s Senior Loan Survey is a good forward-looking survey of credit conditions. It measures the tightening or loosening of loan standards to both consumers and businesses and is conducted among senior loan officers at lending institutions.

As the chart below shows, it has also historically been a timely and accurate predictor of recessions. In both 2001 and 2007/08 in the United States, the rise in respondents signaling some or considerable tightening in loan standards was early in signaling a sharp slowdown in economic growth and ultimately recession. In this context, the recent tightening in loan standards in the U.S. is a concern.

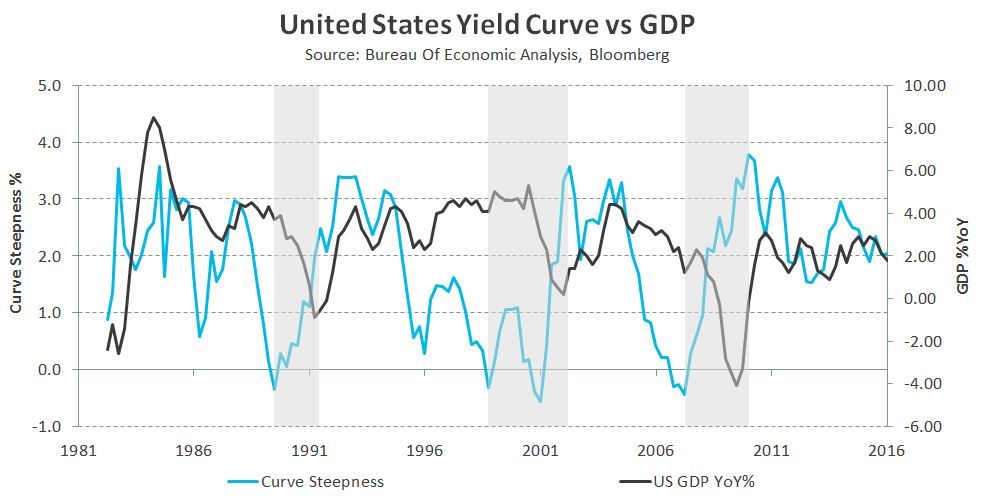

Another useful market-based indicator of recession is inversion in the yield curve. The yield curve charts the interest rate on bonds of different maturities, from the shortest to the longest maturities. The yield curve typically slopes upward to reflect the increased risk associated with lending over longer time horizons.

When the yield curve flattens, it usually reflects expectations of lower short-term interest rates in the future, a signal of weaker economic growth or lower inflation. In an extreme situation, the yield curve actually inverts, i.e. when longer-dated yields fall below shorter-dated yields.

The New York and Cleveland Federal Reserve banks both use the yield curve as a leading indicator of the risk of recession in the near future, typically between two to six quarters ahead.

The curve steepness is typically measured as the spread between the 3-month Treasury bill and the 10-year Treasury note as shown in the below chart. When curve steepness dips into the negative (i.e. when the yield curve inverts), it has frequently preceded the economy moving into recession.

The spread (or steepness) between 3-month Treasury notes and 10-year Treasury notes is currently around 1.40%. By the New York Fed’s calculation, this means there is less than a 5% chance of a recession in the United States in the next 12 months. The Cleveland Fed puts the chances slightly higher, at 6.19%.

However, the yield curve predictor has encountered criticism recently given the fact that the Federal Reserve has anchored policy rates at close to zero. This makes it particularly difficult for the yield curve to invert, and arguably skews the probability of the risk of a recession lower.

“Evidence from other countries that had recessions with near-zero policy rates clearly shows that a flat/inverted curve is not required for a recession to occur. In addition, the Treasury curve is skewed steeper by foreign central bank reserve selling.”

- BoA Merrill Lynch Global Research

When adjusting for the proximity of the policy rate to zero, the yield curve turns out to be much flatter (closer to inverting) than it current appears. Bank of America argues that the curve, using swaps rather than treasuries and adjusted for the zero-bound effect, is already inverted and therefore may already be signalling a recession in the United States.

Assessing the Current Probability of a Recession in the United States

Our assessment across a variety of economic indicators suggests that the risk of recession in the United States is approximately 10% over the next twelve months.

We acknowledge that some indicators of recession (flattening yield curve, tightening lending standards) have risen recently. We also appreciate that the U.S. manufacturing sector, according to the manufacturing PMI surveys, is already contracting; so too are corporate profits.

However, we have difficulty assigning a higher probability to recession risks in the United States. Jobs growth in the U.S. has been the strongest since the Clinton-era, and wages are showing signs of rising. Many of those jobs have been in service sectors which, unlike manufacturing, have been growing and even putting upward pressure on inflation in those sectors.

In addition, U.S. consumer spending is the strongest since 2005, rising 3.1% year-over-year. The United States remains largely a consumer-oriented economy, with consumer spending now accounting for almost 70% of the economy.

Importantly, the recent growth in consumer spending has occurred even though the saving rate has been rising. Through higher savings, U.S. households have materially paid down debt relative to their disposable incomes over the past decade, and this creates further opportunity for growth in consumer spending.

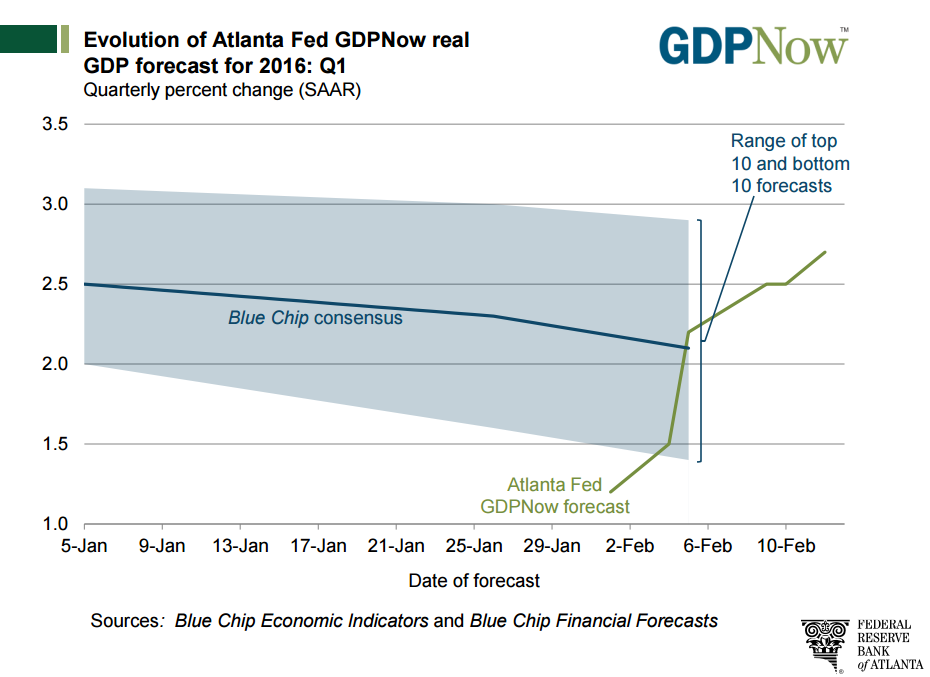

Finally, while financial market volatility has risen sharply on the downside since the beginning of the year, it is important to step back from price information and consider fundamentals and how they have evolved recently. One good barometer is the Atlanta Fed’s own "GDPNow" real GDP forecast. GDP data is released only on a quarterly basis, and often with a significant lag. To mitigate this lack of timeliness, some central banks and investment banks, including the Atlanta Fed, use more timely economic data such as retail sales, factory orders, etc. These data points are released monthly and are direct inputs into the final GDP growth numbers.

Despite financial market volatility since the beginning of the year, those timely economic indicators have been triggering a marked improvement in the Atlanta Fed’s forecast model for Q1 2016 GDP. This is particularly interesting since the Atlanta Fed previously had one of the most pessimistic forecasts for U.S. growth, well below the range of the top blue chip forecasters. Since February 1st, their forecast has shifted into the top end of the range of growth forecasts.

Assessing the Current Probability of a Recession in Canada

We think the risks of recession in Canada are higher at approximately 20%, given the impact of lower energy prices and the lagged effect of a weaker currency.

One reason for not assigning a higher probability is that Canada has never been in a recession without a recession in the United States. It is a possibility that the impact of energy prices, combined with a hollowed-out manufacturing base, leads Canada into a recession without a U.S. or global recession. However, that would be a first for Canada.

Another reason is that there are limited signs so far that the Canadian consumer is rolling over. At a nationwide level net employment continues to rise, and overall consumption remains strong. Although household indebtedness remains a major risk to financial instability in Canada, low interest rates have kept debt servicing costs low by historical standards.

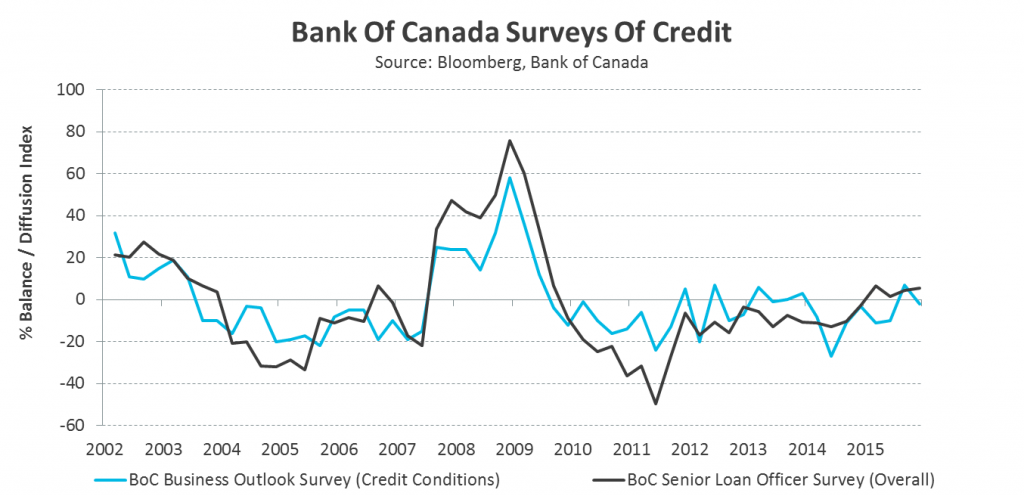

Finally, there is limited evidence of a meaningful tightening in credit conditions in Canada. In fact, survey measures of credit conditions have remained reasonably well balanced since mid-2014 despite the decline in oil prices. We noted earlier that the U.S. survey of credit conditions had tightened, prompting recession concerns due to its historical predictive power. However, this has not been the case yet in Canada. There have also been very limited signs so far of any of the major banks reporting elevated loan losses, including even in some of the major lenders in Alberta.

While acknowledging the risks to our view, our base case scenario is that Canada will avoid a recession. Our view is predicated on the ongoing economic strength in the United States, the absence of a contraction in credit to date in Canada, and robust Canadian consumer spending. This prevents us from assigning a higher probability to a Canadian recession.

1 Shiskin, Julius (1 December 1974). "The Changing Business Cycle". New York Times. p. 222.

2"Business Cycle Expansions and Contractions". National Bureau of Economic Research. Archived from the original on 12 October 2007. Retrieved 19 November 2008.

This LW Perspectives article was prepared by the fixed income group at Leith Wheeler Investment Counsel.

This article is not intended to provide advice, recommendations or offers to buy or sell any product or service. The information provided is compiled from our own research that we believe to be reasonable and accurate at the time of writing, but is subject to change without notice. Forward looking statements are based on our assumptions, results could differ materially.

Recent Posts

- VIDEO: Navigating Dementia: Recognize, Prepare, Plan

- New Trust Reporting Requirements Now in Effect May Catch Some by Surprise

- Leith Wheeler Explainer Series: The Dividend Debate

- Hitting Pay Dirt: The Selling of an Ag Empire

- The Risks of Transactive Memory

- Building Out Your Core with US SMID and Emerging Markets Equities

- Resources for Reconciliation - 2023

- How Could Budget 2023’s Proposed Taxation of Donated Securities Affect Not-for-Profits?

- Taming an Unintentional Portfolio

- Women, Money, and My Holiday Beach Read