March 25, 2021

Challenging the Way You See

I recently came across this Harvard Business Review article by Adam Brandenburger: “To Change the Way You Think, Challenge the Way You See”. In it, Brandenburger – who is a professor of Engineering, Business, and Creativity & Innovation – illustrates through examples the value of being aware of not only what you observe in the world, but of how you observe it.

Velcro’s Swiss inventor is featured crawling in the burr-y Alps and twigging (pun intended) to the relationship between “hook and loop”, at a microscopic (and later shoelace) level. Softsoap adapted the messy residue in the bottom of the soap dish into a whole new category: liquid soap. Even the fictional Sherlock Holmes makes an appearance for his ability to (condescendingly) parse the difference between what poor Dr. Watson “sees” and what Sherlock “observes.”

In active investing, seeing but not observing can create significant risk over both the short and long terms. When consensus thinking influences your worldview, at best your investment decisions may track the broad market. At worst, you may follow your similarly blinkered peers over a cliff. Ask anyone who piled into Dot Com IPOs in 1999. Or tulip bulbs in 1637. South Sea Company shares, anyone?

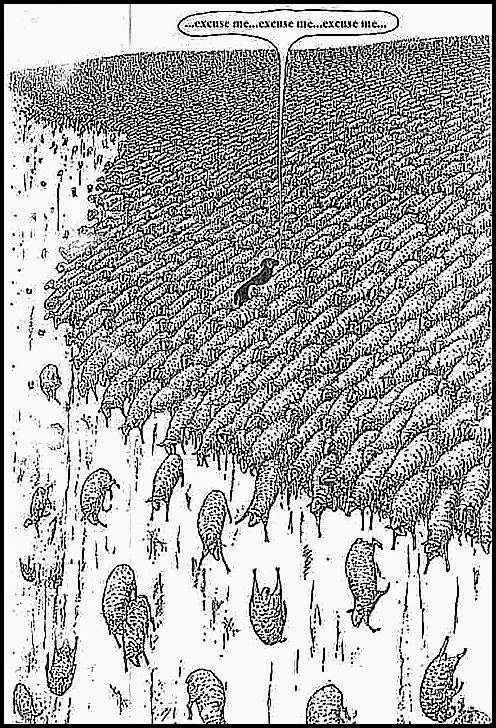

The only way to beat the market is to have an idea that goes against consensus. But the mind can be terribly effective at clouding the truth. Even if you’re aware of your blind spots, those blind spots can persist. So if we want to make leaps of understanding, how can we get out of our usual thinking patterns and look at the world differently?

As we’ve discussed in previous writings about behavioural finance (here, here, and here), there are techniques to protect you from the inadvertently limiting coping mechanisms your brain employs. In addition to trying things like keeping an investment journal, appointing a Devil’s advocate, or leveraging technology to break down social barriers to idea sharing, Brandenburger’s work may be useful.

He suggests that “[w]hen we look at the world, we should not just examine, but examine with a deliberately different perspective. Not just name what is around us, but come up with new names. Not just consider the whole, but break things up (or down) into pieces. These techniques can help us see our way to the new and the revolutionary, whether in the arts or in business.”

The ambition of the article is to embolden great thinkers to discover their greatness, and “build the future.” The reminder to question what you see is just as valuable to investors – and will indeed separate the mediocre from the great.

By Mike Wallberg, CFA, MJ

Vice President, Marketing & Communications

Recent Posts

- VIDEO: Navigating Dementia: Recognize, Prepare, Plan

- New Trust Reporting Requirements Now in Effect May Catch Some by Surprise

- Leith Wheeler Explainer Series: The Dividend Debate

- Hitting Pay Dirt: The Selling of an Ag Empire

- The Risks of Transactive Memory

- Building Out Your Core with US SMID and Emerging Markets Equities

- Resources for Reconciliation - 2023

- How Could Budget 2023’s Proposed Taxation of Donated Securities Affect Not-for-Profits?

- Taming an Unintentional Portfolio

- Women, Money, and My Holiday Beach Read