January 31, 2022

Leith Wheeler Explainer Series: NFTs

When returns have been strong and hordes of cash are chasing fewer and fewer investment opportunities, it is common to see more esoteric options emerge. In the late ’90s it was a smorgasbord of IPOs for anything and everything dot-com. In the mid-2000s it was sub-prime mortgages packaged up into collateralized debt obligations. In the early 2020s, it has been special purpose acquisition companies (SPACs), cryptocurrencies like Bitcoin, and Non-Fungible Tokens, or NFTs. The hype that surrounds these seemingly sexy alternatives can test the mettle of investors, especially when they appear to offer outsized returns just for participating.

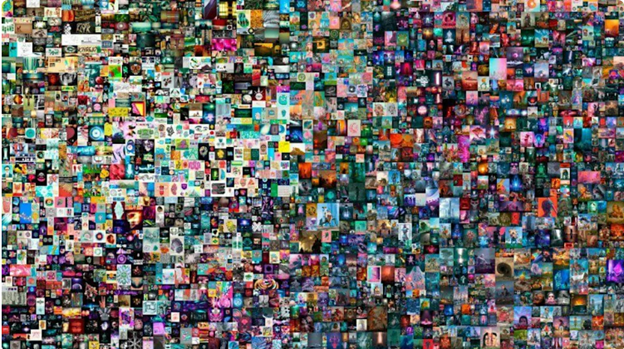

Today we’ll look at the third of these options, NFTs, which have garnered a lot of interest in the past year after a number of high-profile sales were reported – including the sale of one digital image for over $69 million.

What is an NFT?

In simple terms, an NFT is a digital certificate that assigns certain rights to an asset. Think of it as a document of authenticity for a digital file like a photo collage that can attest that this version of the collage is unique. This certification is achieved by leveraging the “blockchain,” the authentication process that similarly identifies individual units of cybercurrency, like digital dollar bills. The blockchain allows all sorts of industries to certify that a digital asset is unique. There are a limited number of Bitcoins, for example, and the blockchain can account for all of them.

The most expensive NFT sold to date: EVERYDAYS: THE FIRST 5000 DAYS by Beeple ($69.3 million)

The primary difference between NFTs and cryptocurrencies is that these tokens are not “fungible” like cash. That means you can’t break the NFT up into smaller pieces and trade them. It is a single asset that can trade hands, like a painting would in real life. Each sale or transfer transaction of an NFT gets recorded using a blockchain platform, creating a verifiable public ledger.

What About NFTs and the Metaverse?

If buying a digital painting is NFT 1.0, the emerging 2.0 application of NFTs is expected to occur in the “metaverse.” The metaverse (and we’re really simplifying here) is a virtual, digital world where one may eventually be able to interact with others in real time and would include both personal (entertainment like gaming and movies) and business applications. A musician could sell NFT tickets to a concert, for example, with the technology acting as a gate to exclusive access. Taking the art example from 1.0, that painting may only exist within the metaverse in one place – the wall of your virtual house.

How and What Am I Actually Buying?

NFTs are generally traded on exchanges like Coinbase or Opensea, a well-known marketplace. Bitcoins or Ethereum are the choice coins for these NFT transactions.

The purchase of an NFT tends to infer the same rights as a buyer of any asset, but one word of warning is this generally does not include any copyright over the original property. The NFT buyer gets the ownership rights of that specific digital version of the asset, but theoretically the copyright owner (the creator) can produce additional versions of the item, like an artist that chooses to sell a limited run of prints. [1]

Should You Invest in NFTs? And are We?

The first question is one only you can answer, but perhaps our perspective may help you frame your thinking.

NFTs are new, but they look in some ways like things we recognize: hard assets such as art or wine that possess “innate” value, or beauty, as long as the eye beholds beauty. If more people see beauty over time, the higher the value will go (or vice versa).

Another way of describing them is “non-productive assets” or stores of value. Aside from perhaps the potential to rent out access to these unique items in the future, most do not have a discernible way of generating cash flows of their own. This puts NFTs in the same category then as gold, Bitcoin, and fiat currency – things people own to speculate on a general future state (economic decline, currency devaluation, etc), not something you invest in to benefit from a management’s skill at turning $1 into $1.15 every year.

The market for NFTs exists largely in the same way that art or wine does, with individual assets being offered for sale. And like art and wine, financial firms are starting to collect these assets into funds and then offering units of these funds to investors. Indices of these funds have followed, along with funds that track these Indices. One example is the December 2021-launched “Bitwise Blue-Chip NFT Index Fund,” which invests in funds that comprise the market’s “most iconic digital art collections.” Comprising just over a third of this Index is the Bored Ape Yacht Club, a collection of 10,000 images of cartoon apes. Bored Ape has a market cap of over $2 billion.

Quiet Money

At Leith Wheeler, we invest in things that possess value, offer the promise of positive free cash flows and growth over time, managed by people we trust, and which are available at a price that – on the balance of probabilities – will allow us to generate a return that compensates us for the risk over the long term. By definition, that means we own businesses, or productive assets that possess intrinsic value. We don’t speculate; we invest. So, the answer, for now, is that NFTs do not appear in the portfolios of Leith Wheeler clients.

Aside from concerns about the investment merit, NFTs also still carry risks given the lack of depth of the market, vanishing transparency, and legal issues involving ownership, governance, and jurisdictions. While crypto exchanges are getting more recognized and improving transparency, NFT marketplaces are still very new with significant risks of legitimacy and intent.

Popular investment vehicles can persist in delivering outsized returns as long as fresh money is infused, chasing yesterday’s returns – the very definition of buying into the hype and hoping it turns into a sustainable investment thesis. Given their relative infancy and speculative nature, NFTs appear to us to fit in this category. We’re prepared to sit them out for now.

[1] There are many interpretations and risks within such smart contracts for tokens' legitimacy, moral, and physical rights. Seek legal counsel for any clarification prior to purchasing an NFT.

Authors

Ankur Saxena

Chief Technology Officer

Mike Wallberg, CFA, MJ

Vice President, Marketing & Communications

Recent Posts

- VIDEO: Navigating Dementia: Recognize, Prepare, Plan

- New Trust Reporting Requirements Now in Effect May Catch Some by Surprise

- Leith Wheeler Explainer Series: The Dividend Debate

- Hitting Pay Dirt: The Selling of an Ag Empire

- The Risks of Transactive Memory

- Building Out Your Core with US SMID and Emerging Markets Equities

- Resources for Reconciliation - 2023

- How Could Budget 2023’s Proposed Taxation of Donated Securities Affect Not-for-Profits?

- Taming an Unintentional Portfolio

- Women, Money, and My Holiday Beach Read