November 12, 2019

Leith Wheeler U.S. SMID Fund Top Decile Performer Over Inaugural 3 Years

When the calendar flipped over September 30 of this year, one of our newer funds attained an important milestone: the three-year track record. We knew that performance has been “good” in the fund, but it wasn’t until we did some analysis this week that we realized how well the team has been delivering risk-adjusted returns for our clients.

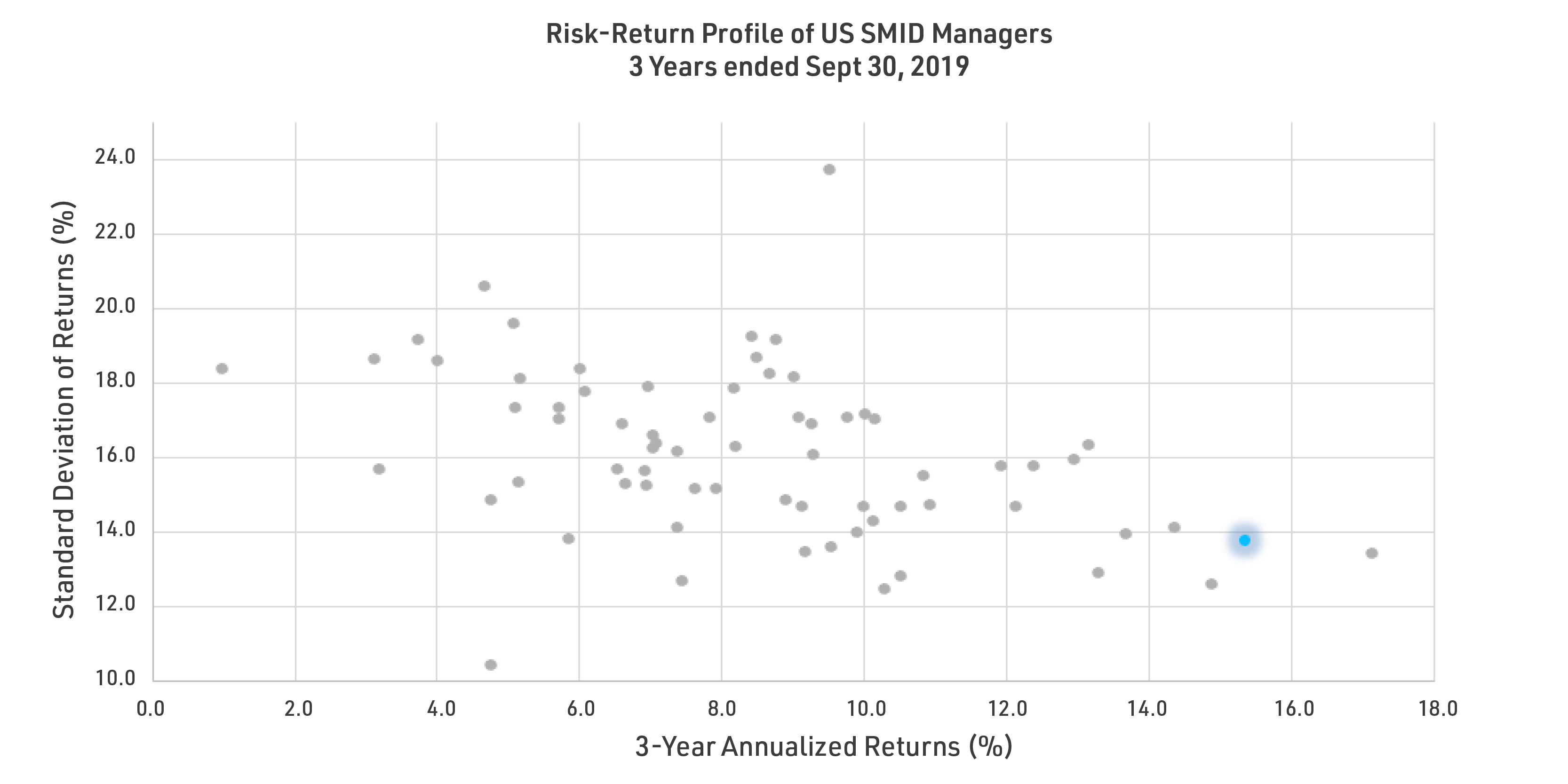

In a universe of 69 peers, the Leith Wheeler U.S. Small/Mid Cap Equity Pooled Fund (SMID Fund) recorded the second-highest compounded annual returns over its inaugural three years, at 15.3% per year before fees (all figures USD, series A)*. The Fund also did so while generating relatively low levels of volatility.

Figure 1 shows the peer group’s returns (X axis – higher is better) against their volatility (measured as standard deviation of returns – lower is better). The Fund (marked in blue) was clearly an outstanding performer among its peers.

Figure 1: Risk-Return Profile of U.S. Small/Mid-Cap Equity Funds: 3 years ended Sept 30, 2019

Source: eVestment.

To discuss the Fund, the team, and their process, we sat down recently with our colleagues, SMID Fund managers Raymond Lai and David Slater.

Leith Wheeler (LW): Who is on the SMID team?

Raymond Lai & David Slater (SMID): The two of us are responsible for proposing ideas and recommending position sizing. The rest of the SMID team – which includes [Leith Wheeler CEO] Jim Gilliland, [Canadian Equity Senior Analyst] Dave Jiles, [Head of Institutional Client] Neil Watson, and [High Yield Manager] Dhruv Mallick – act as a sounding board; provide access to their rolodex of relationships for deeper industry research; stress test the robustness of our hypotheses; and highlight factors we may not be fully considering such as capital structure considerations and quantitative views into the overall portfolio risk/reward impact of new positions.

LW: Can you provide comment on the key drivers of performance since inception?

SMID: We would crudely characterize the outperformance as coming half from stock picking and half from position sizing, though they’re joined at the hip. In hindsight, if we had undersized our winners and oversized our losers, the results would have been very different. Our goal with sizing is to make as much return from the winners while limiting the losses from the losers (this is often referred to as “win/loss” rate). We’ve also had some drag from cash as we’ve tried to be very disciplined in position sizing, and only adding names that meet our standards.

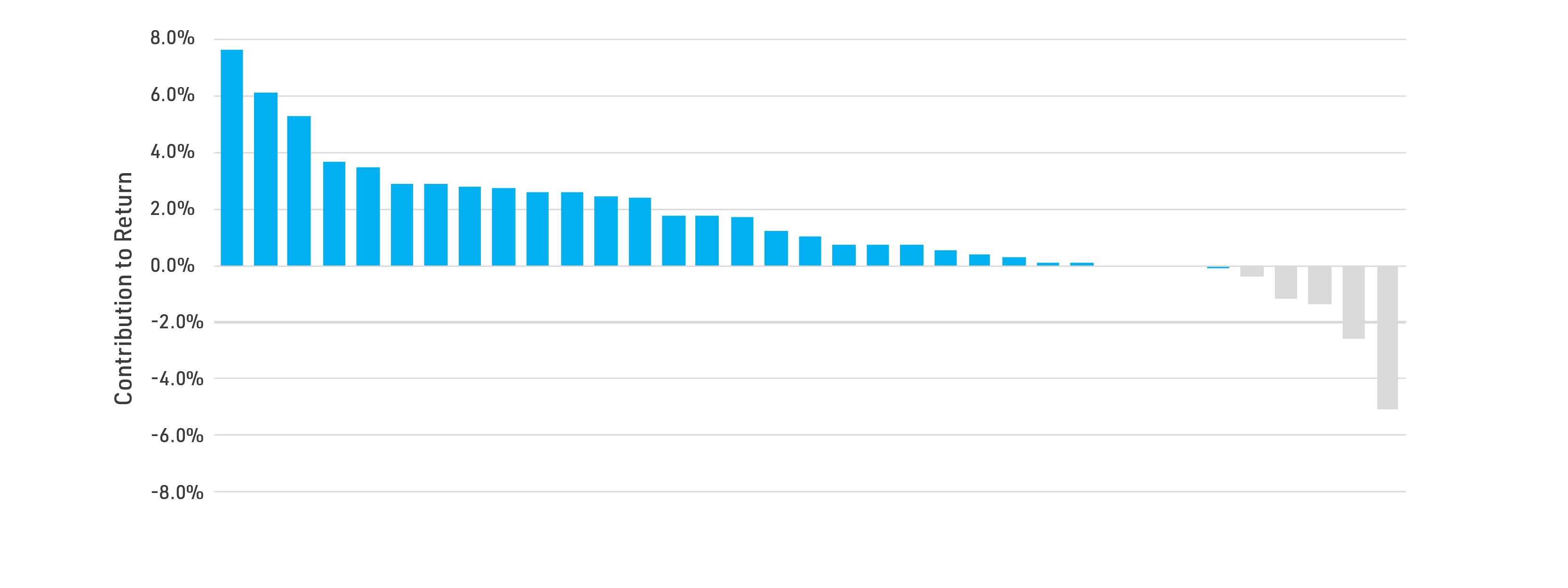

LW: One encouraging characteristic of the SMID Fund’s outperformance since inception is that it hasn’t come from one or two huge wins. Figure 3 shows how various holdings contributed (positively or negatively) to performance. Of note: there were 26 “winners” which contributed to the Fund’s outperformance, compared to only five detractors and five holdings that roughly broke even over the three years. This translates to a “hit rate” of >70%.

Figure 2: Individual stock contributions to performance of Leith Wheeler US Small/Mid-Cap US Equity Fund – 3 years ended September 30, 2019

Which successes stand out for you, and why?

SMID: The two strongest contributors to performance were Live Nation (concert production) and Keysight Technologies (electronics test equipment). Both had dominant business models that were orphaned (ignored) by the market because of margins that were depressed due to multiple years of investing internally. Other investors thought they looked “fully valued” but this created an opportunity for us to buy in cheaply. When their heavy re-investment phases were finished, fundamental improvements in profitability and revenue growth occurred much faster than the market expected, and the stocks rose.

Key to the success of these holdings was first seeing the opportunity, and then having the patience to hold on to them when stock prices rose dramatically. It was a reminder to us that our intrinsic value estimates are simply that – “estimates” – and so we need be humble and creative enough to consider a range of really-good to really-bad scenarios to capture and protect returns for our clients. Intrinsic values are fluid.

LW: On the flip side, what lessons have you learned from disappointing outcomes?

SMID: We had a couple of disappointing outcomes that stand out for us: CommScope Holdings (computer network infrastructure) and Maxar Technologies (space technology). Both were statistically “cheap” shares but in hindsight, we should have trimmed positions earlier, when estimates for the timeline and magnitude of fundamental improvements in the underlying businesses kept disappointing, and our conviction in management and faith in an industry turnaround softened. In the case of Maxar, if we had sold the equity position when Dhruv began selling/trimming his Maxar bonds, we would have had less losses. Our takeaway from that was that we should feel emboldened to sell or trim positions and then buy back later if warranted because, as a nimble fund, we have the capacity and ability to do this.

LW: How do you define and manage risk?

SMID: Some folks internally ran the numbers on our Sharpe ratio, which measures how much volatility you incur while generating excess returns. It turns out we scored very well - #3 in the universe of 69 funds over the first three years. But the fact is, we don’t really think about and manage risk based on expected volatility. We spend our time thinking about and trying to manage actual portfolio and business risk - like how much portfolio exposure we have to certain events or demand drivers, or how much control our individual businesses have over their destinies. In sum, things that directly impact our ability to grow portfolio value over time.

We mentioned the importance of position sizing before, and risk management is a key part of that. We adjust our position sizing based on evolving conviction levels, which are in turn driven by evolving fundamentals. And if the stock price doesn’t rise enough to reflect our new view of intrinsic value, we look to add to positions. We account for estimation error in our intrinsic values at the outset, and then try to be disciplined in revisiting those estimates over time.

In practice, that means being smart (or lucky) sometimes but humble enough to a) not compound mistakes by reactively averaging down when share prices decline – instead taking a beat to first ensure fundamentals aren’t deteriorating relative to our expectations; and b) add/hold when conviction in our intrinsic value estimates grows.

If we had automatically bought/sold/added/trimmed based on our target prices alone, the results would have most certainly have been worse.

The Leith Wheeler U.S. Small/Mid-Cap Equity Pooled Fund is available to institutional clients, and the U.S. Small/Mid-Cap Equity Fund is available to private clients via B series and fee-based advisors via F series.

*Source: eVestment. Universe comprised of 69 US Small/Mid-Cap equities, managed to a Value style. Twenty-eight peers did not report Sep 30 numbers, and one negative outlier removed from sample. While six return figures were reported net of fees, the highest reported net performance was >2% lower than Leith Wheeler’s figure (which was reported gross of fees). Leith Wheeler U.S. Small/Mid-Cap Equity Pooled Fund and Leith Wheeler U.S. Small/Mid-Cap Equity Fund report performance in Canadian dollars.

Recent Posts

- VIDEO: Navigating Dementia: Recognize, Prepare, Plan

- New Trust Reporting Requirements Now in Effect May Catch Some by Surprise

- Leith Wheeler Explainer Series: The Dividend Debate

- Hitting Pay Dirt: The Selling of an Ag Empire

- The Risks of Transactive Memory

- Building Out Your Core with US SMID and Emerging Markets Equities

- Resources for Reconciliation - 2023

- How Could Budget 2023’s Proposed Taxation of Donated Securities Affect Not-for-Profits?

- Taming an Unintentional Portfolio

- Women, Money, and My Holiday Beach Read