May 14, 2021

The Inflation Clash: Will it Stay or Will it Go?

Last month, both Canada and the US reported a rise in inflation of greater than 2% for the first time since the pandemic began. When combined with unprecedented fiscal policies around the world, financed by an expansion in the supply of money, there are understandable concerns mounting among our clients about the risk of inflation.

These concerns are likely to grow over the coming months due to the “base effect” on the calculation of inflation. Base effect refers to the mathematical impact of comparing one period – say, June 2021 price levels – to a previous period that was abnormally depressed, like June 2020. The base effect of this one-year calculation will lead to reports of “inflation!” despite price levels just returning back to relative normal. The same thing occurs when companies report mediocre earnings, a year after barely remaining profitable: the year-over-year “growth” can thus look enormous.

There are also signs, however, that the rise in inflation is due to factors beyond just this base effect. The extent to which this rise in inflation proves to be either the result of the base effect and is temporary/transitory, or the rise is more permanent, is arguably the most important question for capital markets over the next decade.

The Great Moderation

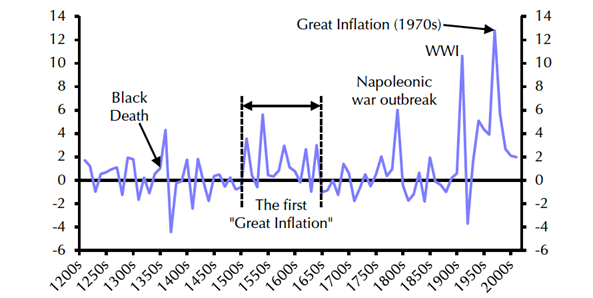

High inflation is not something that most people are familiar with. Inflation peaked in Canada in the mid-1970s (and again in 1981) at levels in excess of 12%. In the G7 countries, inflation peaked at 16.1% in 1974. Since 1981, inflation (and bond yields) have been declining steadily, a period commonly referred to as The Great Moderation. However, the 1970s was an aberration in a historical context, as such periods of sustained, high inflation across multiple developed market economies was unprecedented. The argument that history repeats itself is, in fact, an argument for continued, moderate inflation, rather than a return to the 1970s inflationary period. For interest, we have included an ultra-long data set of inflation experienced in the UK in Figure 1.

Figure 1: Decade Averages of UK/Great Britain/England CPI Inflation since 1200 (%)

Sources: Bank of England, Capital Economics.

Inflation is a complex topic. Academics and policy makers debate both its definition (the Bank of Canada has 4 measures of inflation – headline, trim, mean, and common) and its causes (monetary inflation, demand pull, cost push). Measuring the actual inflation rate is fraught with challenges as to the appropriate basket of goods/services to use, and how to treat the cost of shelter (or owner’s equivalent rent). Then there are all the adjustments, including things like “hedonic” adjustments, which lower the inflation rate to reflect technological advancements which continue to accelerate. Finally, all our estimation models were developed without contemplating the uncertainty created by the unprecedented current monetary and fiscal stimulus, following a one-in-100-year pandemic.

No one knows with certainty what the inflation rate will be over the next 10 years, and therefore our starting point when thinking about this topic includes a sprinkling of humility, and consideration of both sides of the argument for and against inflation.

We Are Not Overly Alarmed About Inflation in the Near Term…

Our view is there are valid arguments that can be made for higher or lower inflation. But on balance, we believe disinflationary risks will persist and that the current, elevated expectations of inflation risks are fully priced into capital markets.

We also note that the increase in inflation expectations reflected in real return bonds has been most prominent in short-dated bonds, such that the inflation breakeven curve (which measures market-based expectations of inflation over time) has inverted. An inverted curve means that although short-term inflation expectations have been rising, this rise in inflation will be short-lived.

Furthermore, these real return bonds are linked to “headline inflation,” which includes everything in the calculation, as opposed to core inflation, which excludes the more volatile components (such as commodity prices). To us, this implies the rise in short-term inflation expectations is again more likely due to a combination of base effects. Core inflation measures in Canada have been notably more stable and below the central bank’s inflation target midpoint of 2%.

The primary reason our longer-term view foresees relatively subdued inflation is that many of the factors behind the Great Moderation in inflation persist today:

- Economies today are much more open to foreign competition, with foreign trade representing approximately 50% of GDP versus just 25% back in the 1970s. Even just the threat of offshoring applies downward pressure on local labour markets;

- Economies are more efficient, with automation (or even just the threat of automation) making it more difficult for employees to negotiate substantial wage increases;

- Wage and price-setting agreements are much more functional today than in the 1970s;

- Labour and product markets are more competitive;

- The Internet has provided us with an unprecedented degree of consumer price transparency;

- Technological innovation continues at an unprecedented pace, pushing down the cost of certain goods quickly as they become technologically obsolete; and finally

- Inflation targeting by central banks has helped keep long-term inflation expectations in check. There is significantly less uncertainty today about the efficacy of monetary policy, specifically the ability of higher rates to curb/crush demand and bring an inflationary spike under control.

Our view is that these powerful disinflationary forces that have been responsible for the decline in inflation since the 1970s will remain in place over the next decade.

…But Upward Pressures on Inflation Do Exist

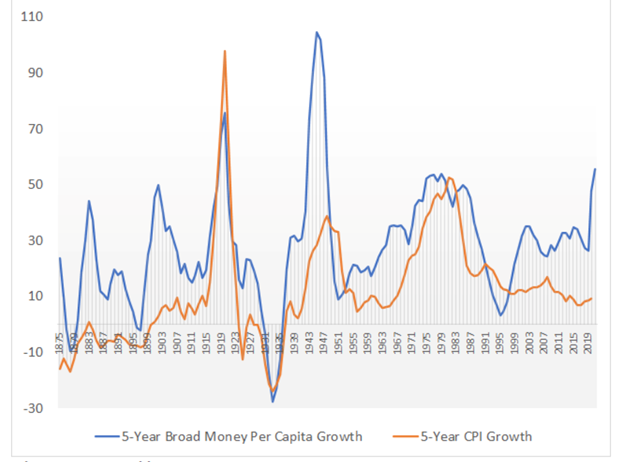

However, certain risks of higher inflation on the horizon are rising. As Figure 2 shows, expanding the monetary base has been shown empirically to correlate with higher rates of inflation over longer-term cycles.

Figure 2: Comparing Expansion of the Monetary Base to Inflation Over Time: US “Broad Money” versus CPI, Rolling 5-year Cumulative Growth (%)

Source: Oscar Jorda, Moritz Schularick, and Alan M. Taylor. 2017. “Macrofinancial History and the New Business Cycle Facts.” In NBER Macroeconomics Annual 2016, volume 31, edited by Martin Eichenbaum and Jonathan A. Parker. Chicago: University of Chicago Press.

Globalization has declined somewhat as a result of the pandemic and the deterioration in US-China relations, with onshoring of the production chain resulting in upward pressure on US domestic wages. There are also signs of commodity price inflation pressures building, and also inventory shortages as demand shifts from service sectors (that have been closed down due to the pandemic) to certain goods sectors.

However, we see many of these factors as temporary in nature. Fiscal stimulus will likely fade as incomes rise and the economy reopens. Globalization might have declined but will remain a persistent disinflationary force, particularly as companies remain profit-motivated to produce goods at the lowest cost. The impact from the US-China trade war will likely be to the benefit of other nations, including Southeast Asia as offshore production simply relocates to the lowest production region. And finally, the effects of inventory shortages and commodity price increases will likely prove transitory, forestalling any prolonged or spiralling rises in inflation.

In our opinion, the greatest risk factor for higher inflation is the willingness of central banks to tolerate higher levels of inflation. There has been an undeniable shift from central banks recently towards tolerating higher inflation, achieved through a mix of clear forward guidance (from the Bank of Canada) and a shift to average rate inflation targeting (from the US Federal Reserve). This could translate into higher long-term bond yields as those higher inflation expectations get built into fixed income markets.

There has also been a shift towards more socially minded objectives for central banking, such as the Federal Reserve recently rewording its language to reflect a “broad-based and inclusive” definition of maximum employment. However, monetary policy is a relatively blunt tool for addressing social issues, and is also arguably is a double-edged sword in terms of its effect. Central banks may judge that inflation is the lesser of two evils (the other evil being a full-blown debt crisis) and that higher inflation would be helpful in deflating the fixed nominal value of debt. However, the expansion in the monetary base would also likely further increase social inequality, as the wealthy benefit from asset price appreciation, while inflation in basic goods is likely to have a disproportionately negative impact on low-income families.

Finally, and most importantly, is the issue around central bank independence and credibility. If central banks grow tolerant of higher inflation, this could undermine confidence in their ability and/or willingness to maintain price stability, with very important implications for long-term growth, interest rates, currency valuations (and the US$ reserve status)[i] and our clients’ investment portfolios. Ultimately, a sharp and sustained rise in inflation is not our base case scenario. But the risk of higher inflation due to a policy error by central banks from running monetary policy too loosely, particularly in the US, is rising.

[i] Broda, Christian and Druckenmiller, Stanley. The Wall Street Journal. “The Fed Is Playing With Fire.” 10 May 2016. Link here.

Recent Posts

- VIDEO: Navigating Dementia: Recognize, Prepare, Plan

- New Trust Reporting Requirements Now in Effect May Catch Some by Surprise

- Leith Wheeler Explainer Series: The Dividend Debate

- Hitting Pay Dirt: The Selling of an Ag Empire

- The Risks of Transactive Memory

- Building Out Your Core with US SMID and Emerging Markets Equities

- Resources for Reconciliation - 2023

- How Could Budget 2023’s Proposed Taxation of Donated Securities Affect Not-for-Profits?

- Taming an Unintentional Portfolio

- Women, Money, and My Holiday Beach Read