May 15, 2019

What is Happening in Canadian Natural Gas?

To say the natural gas industry in Western Canada has been under pressure of late would be an understatement. A combination of increased production, lack of spare capacity on existing pipelines, inadequate storage facilities and regulatory issues have all conspired against the industry. However, uncertainty creates opportunity and we believe there is currently significant value in Canada’s natural gas sector.

Where we are

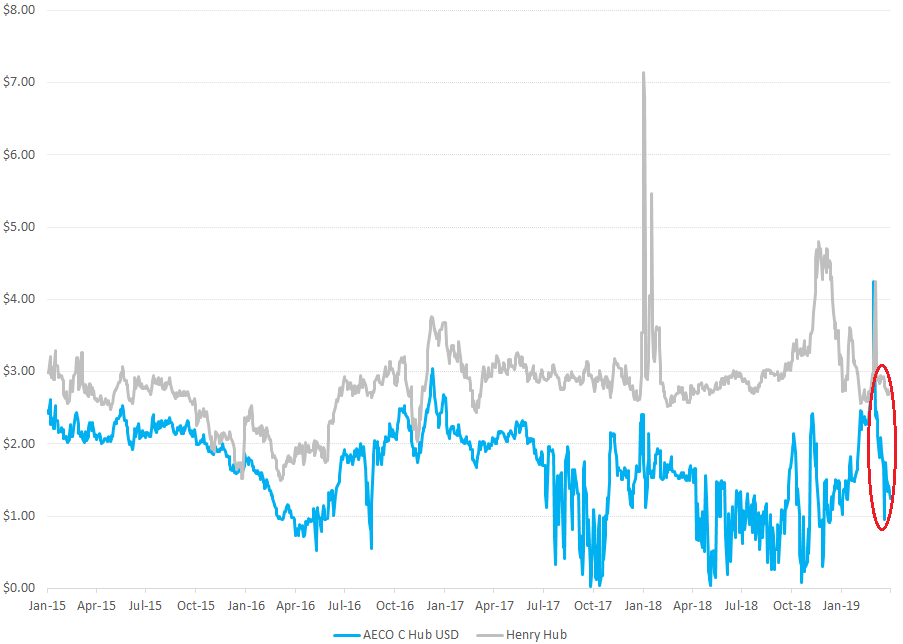

A great deal of the decline in natural gas prices we have witnessed over the last decade can be explained by advances in technology. Horizontal multi-stage fracturing has significantly improved our ability to access tight gas deposits which were previously uneconomic. This has dramatically increased the long-term supply of low-cost natural gas in North America and driven prices lower. Compounding the problem for Canadian producers is the widening differential between prices in Canada and the US. The following chart compares Canadian prices (AECO) versus the U.S. (Henry Hub). As illustrated below, at the end of the first quarter of 2019 AECO was just over $1 versus Henry Hub at closer to $3.

Source: Bloomberg.

In the Spring of 2018, the Government of Alberta established a Natural Gas Advisory Panel to put forth recommendations on actions the Government can take to assist the natural gas industry in Canada (2018 Roadmap to Recovery: Reviving Alberta’s Natural Gas Industry). The committee consisted of Hal Kvisle, who has served as president and chief executive officer of Talisman Energy Inc. and TransCanada Corporation, Brenda Kenny, past president and CEO of the Canadian Energy Pipeline Association, and Terrance Kutryk, former Alliance Pipeline Ltd. president and CEO. The group put forward 48 recommendations focusing on six key areas:

- Grow the Pie by Improving Market Access for Natural Gas

- Encourage Industry Durability and Long-Term Sustainability

- Reduce Dwell (Regulatory Inefficiency)

- Improve Transparency and Accountability

- Drive for Continual Improvement

- Implement Practical Government Oversight

First and foremost, the committee reiterated the need to improve market access for our gas. While we are skeptical new pipeline capacity will be built going forward, existing pipelines have the potential to handle more volume. According to the panel, “most large pipelines could add 10 to 20 per cent to current capacity through software driven operational throughput optimization, compression and looping1”. We also believe liquified natural gas (LNG) has enormous potential to open new markets and we have seen progress on this front. Shell and its partners at LNG Canada have received approval on phases I & II of their Kitimat project and construction is under way. Phases III & IV are expected to be approved this summer. To give a sense for scale, LNG Canada would represent 25% of Canada’s supply, once built.

What can be done

We cannot explore each of the panel’s 48 recommendations here, but we would like to highlight a tangible change that could be implemented relatively quickly given the political will. It used to be the case that when pipeline maintenance occurred, the government would coordinate with companies to constrain production. This approach resulted in a relatively stable pricing environment. In the summer of 2017, a regulatory change came into effect which ended this coordinated approach to dealing with pipeline maintenance. This is problematic as capacity on existing pipelines in Western Canada is very tight. Without a coordinated effort to reduce production it becomes a race to the bottom, with weak producers being forced to shut in production to resolve the temporary oversupply.

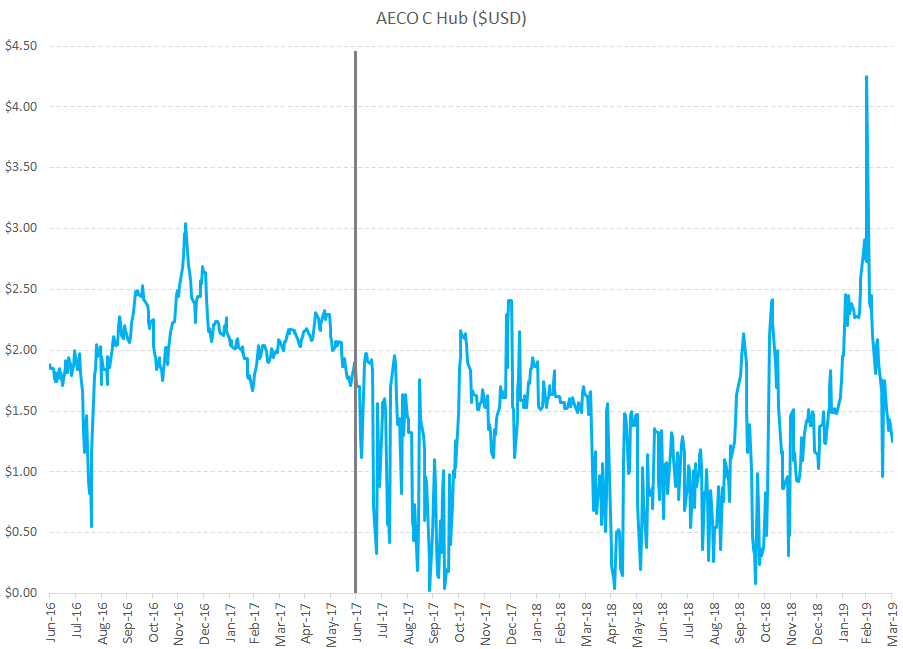

This market-based approach has resulted in severe fluctuations in price over the last 21 months, as demonstrated in the chart below. At times producers have literally had to pay to have their gas taken from them. We are generally fans of free markets… but giving away a valuable resource at pennies on the dollar is ludicrous. The panel recommends the government consider reversing the decision they made in 2017 to bring price stability back to the gas market, and we would agree.

Source: Bloomberg.

Tourmaline Energy

As often happens when an area of the stock market falls out of favour, many investors paint every company with the same brush. The reality is certain companies have taken measures to navigate the challenges facing the industry better than others.

A perfect example in our minds is Tourmaline Energy, the largest energy holding in our Canadian equity portfolio. While many Canadian producers are extremely exposed to AECO pricing, Tourmaline has diversified its customer base by signing long-term contracts at multiple hubs in the United States (Dawn, Chicago, Ventura, San Francisco). They have also hedged a sizable portion of their production. As evidence, Tourmaline’s realized 2018 gas price was $2.73/mcf, compared to the AECO benchmark price of $1.51/mcf (an 81% premium!).

Tourmaline has also done a good job of diversifying their product mix over time. The areas they operate in provide opportunities to extract liquids (e.g., oil, condensate, propane and butane) which receive better pricing than we are currently witnessing in natural gas. Tourmaline doubled the amount of liquids it produces over the last couple of years and production will increase to 72,000 barrels per day by the end of 2019. Finally, the company is well positioned to benefit from LNG in the future given the location of their land, size of their gas portfolio, strong balance sheet and relationship with Shell.

One of our favourite Warren Buffet quotes is, “Be fearful when others are greedy and greedy when others are fearful.” As Value investors we get interested in areas of the market when others are not. With that in mind, it is hard to find an area of the market that is more out of favour with investors than Western Canadian natural gas producers. This cloud creates opportunity and we were adding to quality Energy companies like Tourmaline in late 2018 at deep discounts to what we believe they are worth. Tourmaline subsequently rallied 26% in the first quarter of 2019, making it one of the top contributors in our Canadian Equity portfolio to start the year.

Recent Posts

- VIDEO: Navigating Dementia: Recognize, Prepare, Plan

- New Trust Reporting Requirements Now in Effect May Catch Some by Surprise

- Leith Wheeler Explainer Series: The Dividend Debate

- Hitting Pay Dirt: The Selling of an Ag Empire

- The Risks of Transactive Memory

- Building Out Your Core with US SMID and Emerging Markets Equities

- Resources for Reconciliation - 2023

- How Could Budget 2023’s Proposed Taxation of Donated Securities Affect Not-for-Profits?

- Taming an Unintentional Portfolio

- Women, Money, and My Holiday Beach Read