August 16, 2023 | Quiet Counsel | 8 min read

Inflation, Recession, AI, Oh My! Investment Themes Driving Markets in 2023

In our business, it is often a challenge to communicate how our macro views (“We expect an economic soft landing”) maps to our view of portfolio (“We were happy to see Company A raised its dividend again”).

Visit our website, to download previous Newsletters and read our latest Insights.

While our economic outlook is one input into our forecasts for a company or sector’s earning potential, it is only one input. Part of the reason is that in truth, getting the timing (and sometimes even the direction) of macro forecasts correct can be very challenging. And if we’re buying a business for the long term, in 10 years’ time whether we bought in year one or two of a two-year recession will not prove as important. So we look at the nuts and bolts of a business, understand the drivers and risks to its cash flows, the skill, alignment, and integrity of its management team, the sharpness of its competitive edge, and the price being asked. You’ve read these lines from us many times before because they are at the core of our bottom-up process.

With that being said, market themes can have an impact on both earnings and stock prices in the short term, so it can be an interesting exercise to step back and understand the exposures of our portfolios to those themes. In this edition of Quiet Counsel, we look at three themes that are likely top of mind for our clients: inflation, a possible recession, and artificial intelligence.

Inflation

“The first thing to understand about inflation this time around, is that it’s different from the late 1970s, early 1980s,” says Canadian equity head, Dave Jiles. “Companies have [more] pricing power, driven by the shortage of labour.”

While that may be true more generally, when it comes to raising prices to protect profit margins during periods of inflation, not all companies are created equal. In our Canadian equity portfolios, we hold several businesses that have those price increases actually written into their contracts, including Ontario electricity transmission and distribution company, Hydro One, which as a regulated utility is able to increase prices when costs rise to ensure it continues to earn a target return on equity, and Brookfield Infrastructure Partners LP (“Brookfield”), which has similar pricing contracts that are indexed to inflation. A number of our Canadian Industrial holdings with strong market share and pricing power have also been putting through price increases over the last 18 months. They include Caterpillar dealers Finning and Toromont, along with transport stocks CN Rail and Mullen Group.

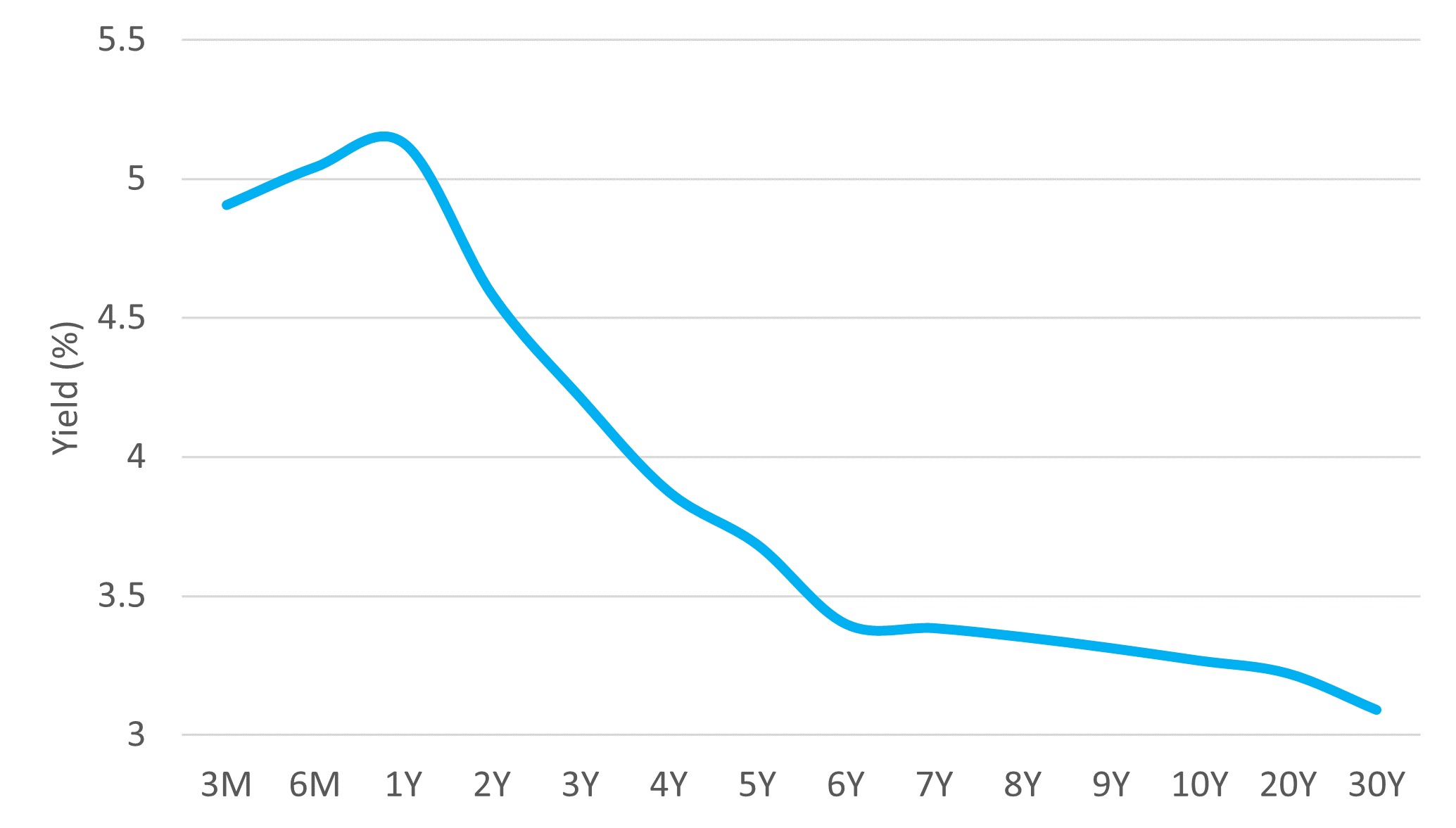

One of the downsides to high inflation is that when central banks increase short-term interest rates to combat it, it can cause the yield curve to “invert,” with medium and long-term interest rates staying lower than short-term ones. See Figure 1. For banks – which borrow short-term (paying interest to savers) and lend long-term (via mortgages and other loans) – this puts pressure on their profits. We’ve seen a deceleration in earnings growth as a result, and matching stock performance in recent quarters. (With their credit books still looking relatively healthy, attractive valuations, and dividend yields of four to six percent or more, though, we’re content to continue owning the Canadian banks – with tempered expectations for near-term growth and an acknowledgment that a recession would prolong that earnings recovery.)

Figure 1: Canadian yield curve, June 30, 2023

Recessions

As Leith Wheeler CEO Jim Gilliland outlined earlier this year in “Recession, Bonds, and Equity Markets” and covered in this video, the economic data currently suggests Canada may achieve a soft landing. Whether that proves correct or optimistic, our portfolios are comprised of stock theses that are designed to pay off in a variety of circumstances – sometimes even in the face of an economic downturn. Looking across portfolios, we broadly hold four types of stocks for clients:

1. Companies with low economic sensitivity. One sector in this camp is healthcare, because the economy doesn’t tend to impact people’s spending on their health. In our global portfolio we hold AstraZeneca (oncology drugs), Medtronic (pacemakers and insulin pumps), and AmerisourceBergen (drug distribution); along with Dollar Tree, whose sales also tend to be stable over economic cycles.

2. Long-term secular growers. Nothing beats an economic headwind like a structural-growth tailwind. Examples of businesses with growth drivers we expect to transcend business cycles include US outpatient surgery provider Tenet Healthcare; Autodesk, which is driving workflow digitalization in architecture, construction, and manufacturing (makers of AutoCAD); and big tech players Alphabet and Meta, which are benefitting from advertising digitalization and AI.

“Brookfield [mentioned above] also has a knack for identifying underperforming and/or undervalued assets, investing to improve them, and selling on for a high return on investment,” says Canadian equity analyst Nick Szucs. “Its long history, global reach and relationships, extensive in-house experience, and deep pockets enable the Brookfield team to rinse and repeat this approach over and over” irrespective of economic environment.

3. Companies with a potential catalyst. “These companies are in charge of their own destiny. They are typically implementing specific strategies to improve their businesses or restructuring to unlock additional value,” says Global equity head, Virginia Au. “This is an area where our Leith Wheeler bottom-up investment process shines because it requires a deep understanding of the industry and business in order to identify inflection points.”

Virginia points to a couple of our newer global holdings: Match Group, which is turning around Tinder and Expedia, which is focused on driving stronger customer loyalty. Autoparts manufacturer BorgWarner is spinning off its highly profitable but slow-growing fuel injection system, to focus on supplying propulsion systems for electric vehicles. “We expect these separations will allow for more focused management and capital allocation, in addition to more straight-forward valuation by investors,” she says.

4. Companies with high economic sensitivity but the risks are well-known and mis-priced. Companies in this category are the opposite of #1: we expect their businesses to slow down when the economy dips. The opportunity here arises when the stock price reflects excessive pessimism. For example, as a potential recession looms, professional recruiting company Hays and mobile phone chip maker Qualcomm are seeing lower hiring activity and delays in phone upgrades… but their stock declines infer professionals will never be hired again and no one will ever change their cell phones.

"Nothing beats an economic headwind like a structural-growth tailwind."

Commodities are often considered synonymous with economic sensitivity, with good reason. But discerning which companies carry manageable debt and possess the greatest upside from current depressed levels can make the difference between a winner and a dud. Canadian copper producer First Quantum, for example, headed into the last big recession with 5-6x Debt/EBITDA; this time it’s just over 1x. Similarly, natural gas producer Tourmaline has almost no net debt – so when natural gas declined from $10 to $2/mcf, for the team at Tourmaline, it spells opportunity rather than tragedy.

This is the toughest category because it requires patience and tenacity. Once the inflection point comes, though, these opportunities often yield the highest returns.

Artificial Intelligence (AI)

Without question recent advances in AI by organizations like OpenAI (which created ChatGPT) have lit a fire under the stocks of companies hoping to be part of the new thing. The stock price of AI hardware and software supplier NVIDIA Corp, for example, nearly tripled in the first half of 2023 alone, breaching the $1 trillion market capitalization mark. As we discussed in our blog post, Is Google Losing the AI Race?, Alphabet (+45% year-to-date as of time of writing) has been investing here for years and seems to be benefiting from investor sentiment as well. It’s too early to label the AI gold rush a bubble, but it does resonate with times like 2016-2017, when Canopy Growth went from $4 to $67 in less than a year. Canopy would go on to become the world’s largest cannabis stock worth over $26 billion. It now trades at less than a dollar per share (and is rumoured to be flirting with bankruptcy).

With that said, our equity portfolios do have companies expected to be impacted directly and indirectly by AI. Cost savings will accrue to many industries, especially ones with expensive overhead that can be safely automated, like financial services. As mentioned, Meta is focusing on its AI capabilities and one of the biggest positions in our US small/mid-cap (SMID) equity strategy is Booz Allen, which is a consultant to US Defence, Civil, and Intelligence agencies. “While it has strengths in AI, it is also strong in cybersecurity and big data analytics, and its partnership-like organizational structure makes it much more operationally effective than its peers,” says US SMID equity analyst David Slater. “It’s also well financed and run for the long term.”

David describes Booz Allen as the type of company the team looks for, and adds that in addition to finding good individual opportunities, managing for risk – at both the stock and portfolio level – is a key part of the process. “Our portfolios are constructed to be resilient,” he says. “By that, I mean we don’t unduly line up risk exposures between names – we diversify enough – and we pay particular attention to position sizing such that our riskier names (i.e., those with a wider range of potential outcomes) occupy smaller positions in the portfolio.”

Given the rapid advances in AI, our teams are also sensitive to the higher risks that accrue to companies with smaller competitive advantages – i.e., those with a business model that relies on a performing low value-added, repeatable tasks, that can be replaced by smart tech.

If we had written this article 10, 20 or even 40 years ago, the examples may have differed but the conclusion would have been the same: the best way to choose stocks and manage portfolios for clients starts with defining and adhering to a disciplined process. Buying quality businesses at attractive prices with a long-term view works - whatever short-term themes dominate the headlines.

IMPORTANT NOTE: This article is not intended to provide advice, recommendations or offers to buy or sell any product or service. The information provided is compiled from our own research that we believe to be reasonable and accurate at the time of writing, but is subject to change without notice. Forward looking statements are based on our assumptions, results could differ materially.

Reg. T.M., M.K. Leith Wheeler Investment Counsel Ltd.

M.D., M.K. Leith Wheeler Investment Counsel Ltd.

Registered, U.S. Patent and Trademark Office.