August 18, 2025 | Quiet Counsel | 6 min read

The (After-Tax) Case for Investing in Canada

Key Takeaways

- Canadian equities offer value. Attractive valuations make them worth a closer look.

- After-tax returns matter. Taxes can materially erode your investment gains.

- Dividends from Canadian stocks are more tax-efficient than from foreign equities, or interest income.

- Asset location is critical. Holding the right investments in the right accounts can improve your tax outcomes.

Home Country Bias: A Strategic Tilt

Some investors worry that leaning too heavily on Canadian equities (carrying a “home country bias”) is a mistake. While diversification across global markets remains important, our research indicates a moderate, strategic tilt toward Canadian equities can be a smart move, especially in taxable accounts. Why? Three main reasons: currency alignment, attractive current valuations, and tax efficiency.

Currency Alignment. If your income and expenses are in Canadian dollars, holding Canadian assets helps reduce foreign exchange risk. Currency fluctuations can be unpredictable and may impact returns, especially for investors in the deaccumulation phase who rely on stable cash flows.

Look at this year. The Canadian dollar appreciated from $0.70 to $0.735 USD/CAD between January and June 2025 for a 5% gain. If you held US stocks during that period, your returns would have been reduced by at least 5% when converted back to Canadian dollars (remember that individuals pay a slightly worse rate than the posted ones). Currency matching helps mitigate this risk.

TSX Valuation Advantage. If we told you that the Leith Wheeler Canadian Equity Fund has outperformed US equities, including the tech-heavy NASDAQ, over the past year, you might be surprised. But the numbers speak for themselves. As Figure 1 shows, as of June 30, 2025, the Fund delivered a one-year gross return of 20.0%, outpacing major global benchmarks.

Figure 1: Leith Wheeler Canadian Equity Fund vs Major Benchmarks, One Year to June 30, 2025

| Local Currency | CAD Return | Forward P/E | |

| Leith Wheeler Canadian Equity Fund | 20.0% | 20.0% | 15.7x |

| NASDAQ Composite Index | 15.7% | 15.3% | 30.9x |

| S&P 500 Index | 15.2% | 14.6% | 23.4x |

| MSCI World – Net | 13.7% | 15.7% | 21.0x |

| MSCI EAFE – Net | 8.0% | 17.1% | 15.9x |

Of particular note, though, is that even after that run, the Fund’s forward price/earnings (P/E) ratio remains below those of the foreign indices. This matters because the price you pay today has a big impact on the return you get in the future, especially over longer time periods. Figure 2 shows the inverse relationship between valuation (P/E) and the 10-year performance of the S&P 500 over the last 70 years: the lower the starting multiple, the better the reported long-term return.

Figure 2: 10-year Returns of S&P 500 Based on Starting Period P/E Multiple

| Trailing Price to Earnings Multiple Range | 10 Year Return (Dec 31, 1954 - Dec 31, 2024)* |

| 25x - 50x | 1.15% |

| 16.6x - 25x | 3.68% |

| 12.5x - 16.6x | 8.90% |

| 10x - 12x | 9.93% |

| 8x - 10x | 10.72% |

| 7x - 8x | 12.24% |

Source: Leith Wheeler, Bloomberg.

*Calculated based on monthly, rolling 10-year returns of the S&P 500 between Dec 31, 1954 and Dec 31, 2024 in US$. Latest 10-year period ends as of Dec 31, 2024.

Tax Efficiency. Canada Revenue Agency taxes different types of income differently – and provides meaningful incentives to invest in Canada. In the following section, we cover the important impact of taxes on your investment performance, and optimal asset location.

Why After-Tax Returns Matter

Most investors focus on pre-tax returns – the headline numbers on their statements – but what really matters is what you keep. In taxable accounts, the difference can be substantial so understanding how to invest in a tax-efficient way is important.

Imagine you have two investments, with each earning 8% annually before tax. If one is taxed at 50% and the other at 30%, your after-tax returns are 4% and 5.6%, respectively. Over 10 years on a $1 million portfolio, that’s a difference of $240,000 – money that could be working for you instead of going to the CRA.

Tax Efficiency Starts with Understanding Income Types

Different types of investment income are taxed differently. Figure 3 breaks down the types of income you’ll receive from investments.

Figure 3: How Different Types of Investment Return are Taxed in Canada

| Income Type | Tax Treatment |

| Interest (bonds, GICs) | Fully taxed as regular income at your marginal rate |

| Foreign Dividends (non-Canadian stock) | Fully taxed, no dividend tax credit; often subject to foreign withholding tax. Canada and the US have a 15% withholding tax treaty which applies to some accounts (the 'revenge tax' clause within the Big Beautiful Tax Bill which threatened this treaty was thankfully removed) |

| Capital Gains (stocks, some bonds) | Only 50% of gains are taxable |

| Eligible Canadian Dividends (Canadian stocks) | Eligible for dividend tax credit, reducing tax payable |

Tax Treatment by Account Type

Figure 4 summarizes how each type of investment income is generally taxed in Canada depending on the account type.

Figure 4: How Different Accounts Tax Investment Returns

| Income Type | Non-Registered | TFSA | RRSP | RESP |

| Canadian Dividends | Taxed at preferred dividend rate | No tax | No tax | No tax |

| US Dividends | 15% withholding tax; income taxed, but a foreign tax credit can be claimed | 15% withheld; no foreign tax credit | No tax | 15% withheld; no foreign tax credit |

| Capital Gains | 50% taxable | No tax | No tax | No tax |

| Interest Income | Fully taxable | No tax | No tax | No tax |

How to Structure Your Portfolio for Tax Efficiency

Tax efficiency isn’t just about what you hold, but where you hold it. This is called asset location. A couple of general rules of thumb for maximizing tax efficiency:

- Favour holding interest-bearing investments (like bonds and GICs) in registered accounts where taxes are deferred or avoided.

- Canadian dividend-paying stocks work well in taxable accounts, where the dividend tax credit applies.

Of course, if you are taking monthly withdrawals out of your non-registered account to fund lifestyle needs, or have any upcoming capital needs, it may not be suitable to overweight equities. Your Portfolio Manager will consider this and ensure your portfolio and accounts align with your investment goals and risk profile, and balance tax efficiency with liquidity and risk.

The Nuts & Bolts: Why Canadian Eligible Dividends are Special

Canadian corporations pay two types of dividends: eligible and non-eligible. Eligible dividends are typically issued by larger companies and qualify for the Dividend Tax Credit, a uniquely Canadian tax incentive designed to avoid double taxation of corporate earnings and encourage investment in Canadian businesses. This credit makes eligible dividends far more tax-efficient than interest or foreign dividends.

If you own US or other foreign stocks in taxable accounts, you’ll often face a withholding tax on dividends paid to Canadian residents—typically 15% for US stocks. While you can claim some foreign tax credits in Canada, these do not eliminate the withholding tax entirely. Moreover, foreign dividends do not receive the Canadian Dividend Tax Credit and so are taxed at your full marginal rate and often subject to withholding tax.

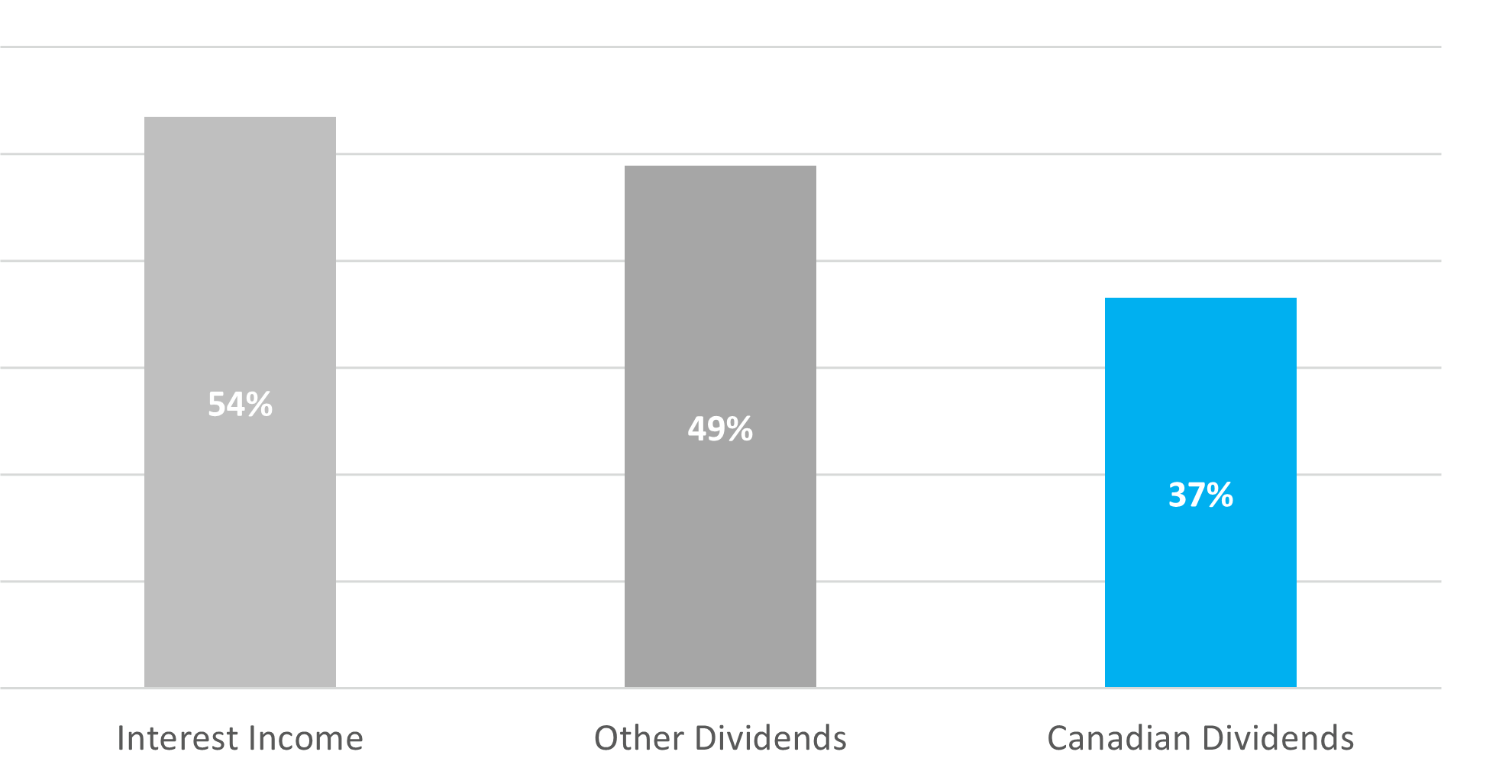

Figure 5 shows the big difference in top marginal tax rates for interest income (bonds), non-Canadian dividends, and eligible Canadian dividends in taxable accounts. As you can see, the resulting leakage for client portfolios can be large if proper asset location is not considered.

Figure 5: Top Marginal 2025 Tax Rate for Investment Income (Combined BC/Federal)

Source: Leith Wheeler estimates, EY.

Note: These figures illustrate the experience in British Columbia; other provinces will vary slightly. Capital gains were excluded from this chart. While they are a tax efficient source of returns, they don’t need to be realized every calendar year and may benefit from the compounded effect of tax deferral (so aren’t apples-to-apples with income).

Final Thoughts

Diversification remains essential, and global exposure should be part of every portfolio, if suitable. But in taxable accounts, a strategic overweight to Canadian equities can offer a compelling mix of currency alignment, attractive valuations, and potential tax savings.