May 16, 2021 | Quiet Counsel | 9 min read

Investing from Page 16

When I was first learning to be a stock analyst, one of the key pieces of advice I received

was to read several papers, cover to cover, every day. While this may seem like a lot,

there was wisdom buried (quite literally) in this advice.

The general benefit is knowledge of themes and trends occurring both within and outside your industry focus, but the gold nugget is the discipline to tear your eyes away from the front page, where very few unexploited investment insights live, and go digging through page 16 – because it’s mainly on page 16 that the genesis for most worthwhile investment ideas can be found.

Visit leithwheeler.com, to download previous Newsletters and read our latest Insights.

Part I: The Perils of Page One

Computers are faster than you

One reason that page one news can be hazardous to an investor’s financial health is that stocks react more or less instantly to surprising news. The publishing cycle for traditional news agencies is glacial in comparison, even in the digital age, so if you’re reading it on the cover of the Globe and Mail, the stock price will have already adjusted to reflect this information. Buying or selling at that point is an entirely reactive exercise, the benefit of which – was I right to sell a day after that bad news? – will have more to do with luck than skill.

Newspapers are tools of the past, not the future

A related concept is that stories that land on the front page are “hot topics,” meaning editors believe that story will appeal to the largest number of their readers. It has buzz. People are talking about it, so the paper needs to report on it. When that’s the case, the risk rises that excesses of sentiment (positive or negative) have already been built into whatever sector or company they’re writing about. The Cannabis and GoPro examples provided below are

good examples of this phenomenon.

Cannabis. Cannabis investing is an area where expectations and reality are only now starting to converge. Were you to follow the excitement and hype of the page one coverage of the industry – from well before it was signed into law in Canada in October 2018 – you would have experienced severe whiplash. (Possibly requiring a prescription for the pain.)

The New York Times headline at the top right illustrates the phenomenon well. Look at that January 2018 peak in cannabis prices in the Figure 1 and then look at the date stamp on the NYT stor y. The Times wasn’t shilling cannabis. They were just repor ting what’s in the marketplace. And as mentioned above, what’s known in the marketplace is often fully baked into the stock prices.

Our approach to this sector has been to approach it as a consumer discretionary holding like alcohol, but subject to the vagaries of a commoditized agri-business. Supply

and demand matter to price, but we’ve been unconvinced these were being considered by investors in cannabis stocks, so we have remained on the sidelines. Many investors, however, bought and sold through this roller coaster and not always with positive results. The most successful ones would have taken the Times story as a contrary indicator i.e., when a company or industry is being promoted on the front page, it’s time to sell, not buy.

GoPro, the “Hot” IPO. Until it Wasn’t. Enamored of its marketing glitz, sexy story, and persistent page one media coverage, investors in GoPro, the maker of cameras

Figure 1: Stock Performance of North American Cannabis Companies, January 2017 – Dec 2019

Source: Visual Capitalist, The Marijuana Index.

for sports enthusiasts, piled into this stock after its June 2014 initial public offering (IPO), sending its price from $24 at IPO to $94 in the first few months alone. At its peak, investors justified paying $65 for $1 of earnings (or a price/earnings ratio of 65x). But this was not to last.

By the time investors realized the company couldn’t possibly keep pace with expectations, the stock had fallen to 12x earnings and as Figure 2 shows, it has languished in this zone ever since. With GoPro, it was a case of vanity over sanity with investors equating press coverage and slick marketing with financial upside.

Figure 2: Stock Price Performance of GoPro, June 2014 to March 2021

Source: Bloomberg.

Business journalists are not experts on every investment topic... and unfortunately sometimes neither are their sources.

The skeptic’s creed, “Just because it’s on the Internet doesn’t mean it’s true” should also be applied to print media. There are many credible publishers out there but even the most experienced journalists are reliant on their sources for their stories. And with credit to Yogi Berra, forecasting is hard, especially about the future. For that reason, investors should take page one prognostications with a grain of salt. The Royal Bank of Scotland case study below is an example of this risk in action.

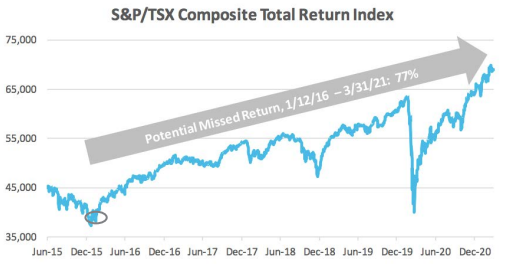

Royal Bank of Scotland. On 12 January 2016, economists at the Royal Bank of Scotland became so concerned about weak oil prices and a poor start to the year for equity markets, that they offered this advice to their clients (which was later leaked to a journalist at UK-based media outlet, The Guardian):

Incidentally (and thankfully for investors everywhere), sufficient was the backlash to that article that a number of papers published editorials challenging the RBS piece, including in this Financial Post story. If you had acted on this page one shocker, however, and sold out of the S&P/TSX Total Return Index that day, you would have done so at effectively the bottom the market, foregoing significant returns over the ensuing years.

Figure 3: S&P/TSX Total Return Index, June 30, 2015 to March 31, 2021

Source: Bloomberg. Simple return shown.

Part II: How Can Page 16 Stories Lead to Investment Wins?

Success in active equity investing comes from having an “edge,” or an insight about a company not known by the rest of the market, which then allows you to buy the stock below its “true” or intrinsic value. As we saw in Part I, when the story lands on page one, that opportunity has

already passed, because everyone already knows it. It’s consensus. Your edge is gone.

It’s for this reason that our investment teams focus on stories that percolate in the back pages of the paper. Through years of experience, we’re occasionally fortunate enough to spot an anomaly, or an important data point in one industry that permits a leap of understanding for assessing the value of a company in another one. It can be a mosaic of ideas that bubble up from these back pages that, in time, can yield some truly excellent investment ideas.

Our value discipline narrows our focus to companies with a temporary cloud over them, that trade below true intrinsic value, because other investors either aren’t paying attention to them, have overreacted to recent bad news, or don’t understand them. These are our sweet

spots, and the insights to uncover them often live on page 16. The following examples detail times where a page 16 story led to a terrific win for our clients.

Brookfield Infrastructure Partners (BIP.UN) is an owner and operator of global infrastructure projects with excellent management. We’ve owned it since 2012, but it didn’t generate a lot of attention back then because Brookfield domiciled (registered) itself in Bermuda, technically making it “foreign content” for Canadian investors and ineligible for inclusion in the Canadian stock indices. For index-focused investors, putting money into an off-benchmark company represents additional “risk” that likely kept it off their radars. Meanwhile, with a huge head office in downtown Toronto, to non-Canadians BIP looked like Canadian content.

The market also underappreciated the resilience of the business’ utility-like cash flows. For example, the company actually posted small but positive year over year growth in free cash flow in 2020 relative to 2019, even with global shutdown impacting most global businesses.

In Figure 4, we marked our entry point with a green circle at just below $20. We’ve trimmed from time to time based on valuation or to manage our overall exposure to Brookfield (we also hold shares in Brookfield Asset Management). In addition to the >3x increase in the stock price, BIP has delivered stable and growing dividends (current yield ~3.9%). It also spun out a subsidiary company (BIPC) in 2020 – which we received at $50/ share. We sold the last of those shares at $88.

Figure 4: Brookfield Infrastructure Partners Price Performance, December 31, 2011 – March 31, 2021

Tetra Teck (TTEK) is a consulting/engineering business we owned in the Leith Wheeler US Small/Mid-Cap Equity Fund. We bought shares in 2016 when it appeared poised to deliver higher and more stable revenues. In prior years, it had struggled with risk controls and exposure to languishing industries, but the company’s move away from construction and growing exposure to government infrastructure looked promising. We built our position around $34/share when it was in the doghouse and sold out of the last of it this February at $135 (during our ownership, management also more than doubled the quarterly dividend). Tetra Teck is still a good company, but its valuation now looks stretched partly because management has delivered, and partly because it’s now a front-page story.

Figure 5: Tetra Tech Inc Price Performance, December 31, 2015 – March 31, 2021

Spin Master Corp (TOY) is a global toy company with many brands you’d recognize from your own childhood including Rubik’s Cube, Etch-a-Sketch, and Erector Set in addition to modern hits like Paw Patrol and Hatchimals. We bought a stake in Spin Master in March 2020, but the timing was less related to COVID declines than you might think. The company had missed earnings expectations repeatedly, exasperating the financial analysts who make their living advising institutional investors like us. It was also experiencing production and distribution delays, along with the departure of their COO. As an unloved page 16 company, we were ready to move when the pandemic created an even more compelling entry point for us to purchase shares in the mid-teens. We eventually sold out in early 2021 for ~$30, for a doubling of our clients’ money in about 9 months.

Figure 6: Spin Master Corp Price Performance, December 31, 2011 – March 31, 2021

Buying and selling stock well requires an ability to see a marvel where others just see a mess, and to resist the temptation of easy insights. Page 16 can contain valuable insight if you know where to look. If it’s on page one, though, probably… it’s time to run.

IMPORTANT NOTE: This article is not intended to provide advice, recommendations or offers to buy or sell any product or service. The information provided is compiled from our own research that we believe to be reasonable and accurate at the time of writing, but is subject to change without notice. Forward looking statements are based on our assumptions, results could differ materially.

Reg. T.M., M.K. Leith Wheeler Investment Counsel Ltd.

M.D., M.K. Leith Wheeler Investment Counsel Ltd.

Registered, U.S. Patent and Trademark Office.