August 16, 2021 | Quiet Counsel | 9 min read

Investing vs Speculating

I have a confession to make: in 2014, after holding on for five years, I sold my remaining Blackberry shares for C$10.32 per share, for a loss of almost 90%. This incident was thankfully) relatively isolated and involved a small amount of money I could afford to lose but it was also a great source of learning because it showed me the difference between speculating and investing.

I began my finance career in September 2008, the very month that Lehman Brothers’ collapse sent markets shuddering into a massive freefall and pushing Canadian markets down 35% on the year. The following spring, Blackberry was trading down 45% from its recent highs and new US President Barack Obama was a vocal and visible advocate for their phones. It seemed like easy money. At the time, I thought I was investing in Blackberry, but in hindsight the truth is I was speculating. I knew very little about the fundamentals of the business but let the crowd around me and the idea of a “quick gain” drive my investment decision.

I had forgotten all about my Blackberry faux-pas until it recently hit the headlines again as one of the “Reddit” stocks (explained more below). Thirteen years later, it is a company with negative earnings per share, negative return on equity, and a negative profit margin but is up 54% YTD at the time of writing (and at one point in January was up over 112%). The glaring reality of the speculation driving its price gives me comfort because this time I felt no twitch to join the fray.

Why do we speculate?

Speculation is embedded in the world of investing and in many ways, our brains are wired for it. In fact, studies have shown that some forms of financial trading elicit similar neural responses to a brain on cocaine 1 . While some forms of speculation are necessary to keep markets moving along where would we be if everyone required perfect certainty before investing in any idea? as fundamentals slip further down the priority list, systemic risk levels can increase and speculative bubbles can form. We have covered various cognitive and emotional biases in previous writings (here, here, and here) but here are a few specifically relevant to speculative trading:

Anchoring. The use of irrelevant data to make decisions for example, observing a large stock price decline and concluding that the stock is now “cheap” by virtue of the decline alone.

Hindsight Bias. The tendency to view past events as more predictable than they really were and then erroneously believing that we would have had more control over a situation than was the reality. Related concepts are the Fading Affect and Egocentric Biases which are the tendency to forget our mistakes and overemphasize our wins.

Herd Mentality Bias. A tendency to “follow the crowd” and copy what other investors are doing. One of the biggest fuels for investment bubbles and mania, herd mentality bias has only become a bigger force in the age of mass information, social media, and Fear of Missing

Out (“FOMO”).

Greater Fool Theory. A perceived ability to buy and sell the stock quickly enough to profit off a “greater fool” aka the next person rushing in. Fundamentals are thrown out the window as this becomes a game of pure momentum, with someone ultimately left holding the bag when prices come back down to earth.

"While some forms of speculation are necessary to keep markets moving along, as fundamentals slip further down the priority list, systemic risk levels can increase and speculative bubbles can form."

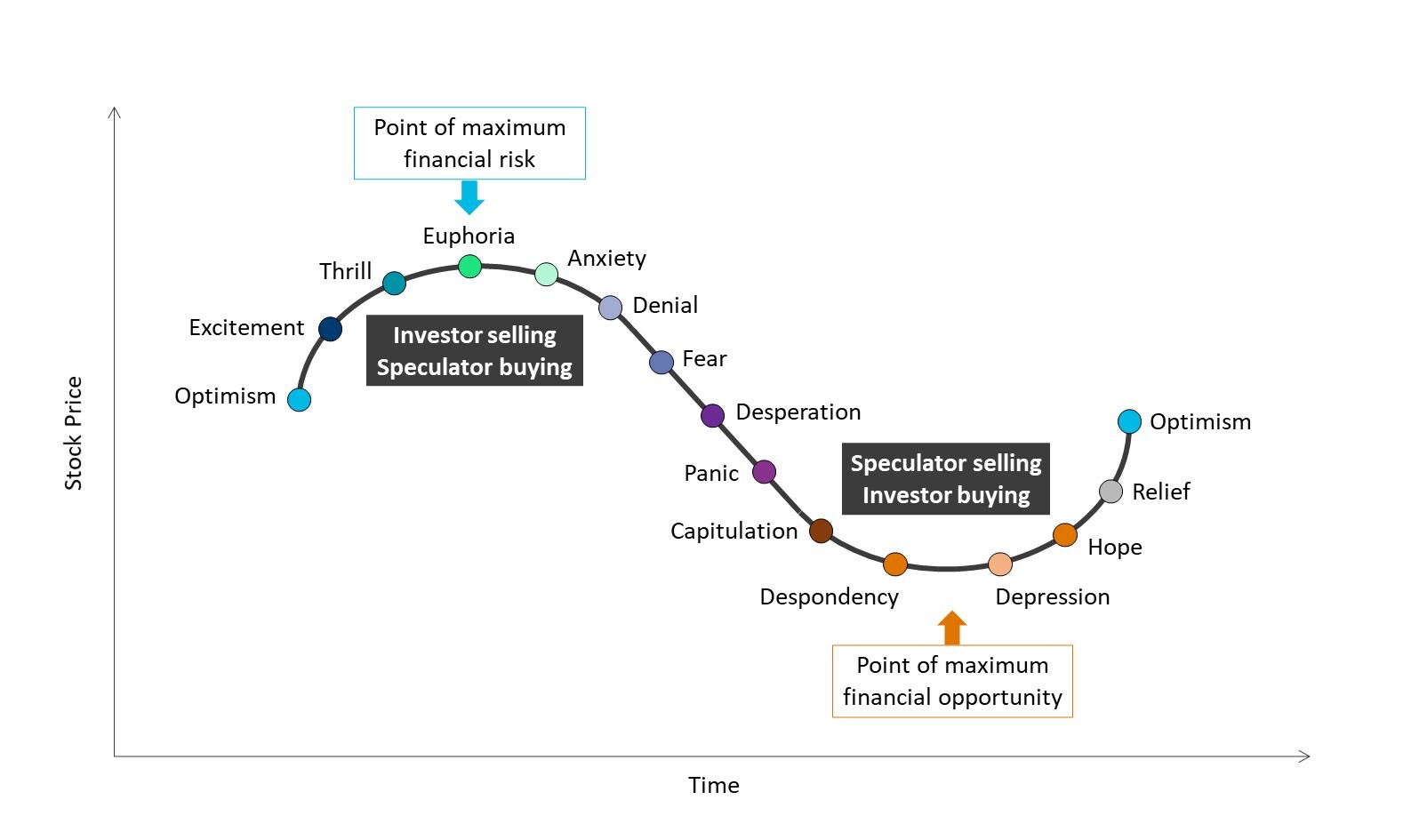

The hard truth is that many individual investors fall prey to these biases and therefore enter speculative territory causing them to underperform the broad market. Figure 1 shows the theoretical emotional journey of a speculator through the hypothetical lifecycle of a stock, leading them to make the exact wrong decisions at key inflection points. All things being equal, at these extremes, price sensitive, quality-aware investors are more inclined to do the more prudent opposite.

Figure 1: How speculating based on emotion plays out over a cycle and fundamental investors capitalize

With trillions of dollars currently being pumped into financial systems around the world, anemic returns available in bond markets, and a sense of hubris from the astronomical stock market gains coming out of the short-lived COVID-19 crash, investor/speculator appetite for risk-taking is high. While we don’t see the broad markets as overvalued (discussed here), there are definitely speculative pockets that give us pause. Here are a few examples.

Cryptocurrencies (Bitcoin, Ethereum, Dogecoin)

After hitting all-time highs earlier in 2021, cryptocurrencies have remained extremely volatile. While they tend to polarize, we view cryptocurrencies as vehicles for short-term speculation, rather than a true investment. One only has to look at the concentration of ownership (95% of Bitcoin is owned by only 2% of its holders), and the sway that social media and various public figures like Elon Musk 2 have had on pricing illustrates that fundamentals are not really driving the bus here.

Ironically, dogecoin, which started as a joke aimed at the cryptocurrency markets in 2013, became one of the more recent hot cryptocurrencies, vaulting off of its <1c price to peak in May above 69c. It’s since fallen 70% but still has a quoted value over $1 billion.

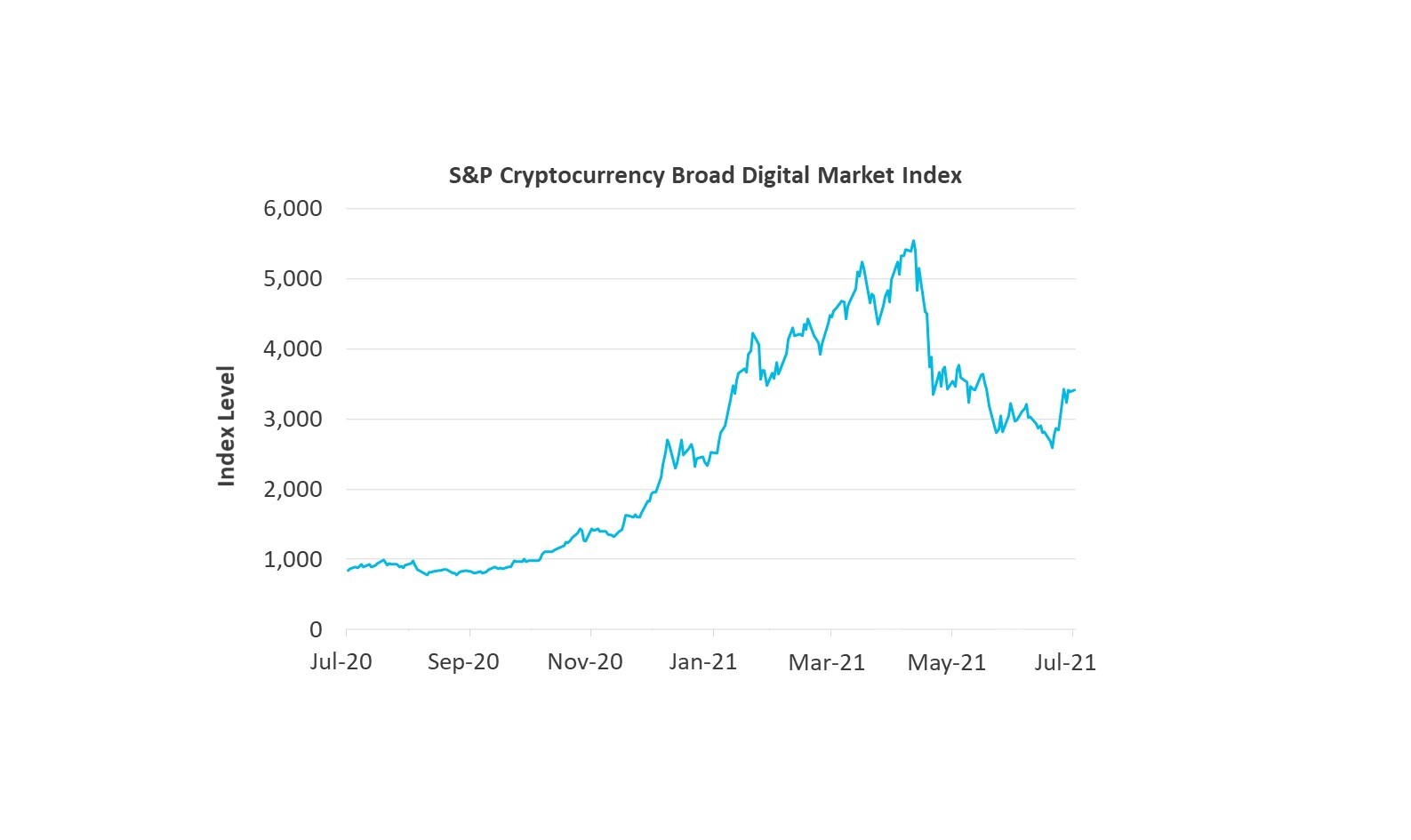

Figure 2 shows how a basket of 240 cryptocurrencies (over 60% weighted to Bitcoin and Ethereum), increased over five-fold in the last year, before checking back somewhat.

Figure 2: Volatility of cryptocurrency, July 31, 2020 – July, 31 2021

Robinhood/Meme Stocks

The so-called “Robinhood” or “Meme” stocks that have made the news in recent months represent speculation in its purest form. GameStop, AMC Entertainment Holdings and, yes, Blackberry have seen their stock prices soar for reasons wholly unrelated to the quality of their management or the forecast for their cash flows. What started as a venting of anger among Reddit forum users about short selling by Wall Street quickly escalated. Stocks of these companies jumped on escalating buying from Redditors and then Wall Street firms got caught in a “short squeeze.” 3 More Redditors piled in due to FOMO after seeing their friends making easy money. The stocks continued surging, with none of it based on the underlying business fundamentals.

Figure 3 shows the enormous swings in value of GameStop in 2021. “Get rich quick” Redditors who bought at those peaks paid for all the gains of those lucky enough to sell in time (perhaps to the “Greater Fool” as referenced above).

Figure 3: Stock price history of GameStop, 2021 YTD

Special Purpose Acquisition Companies (SPACs)

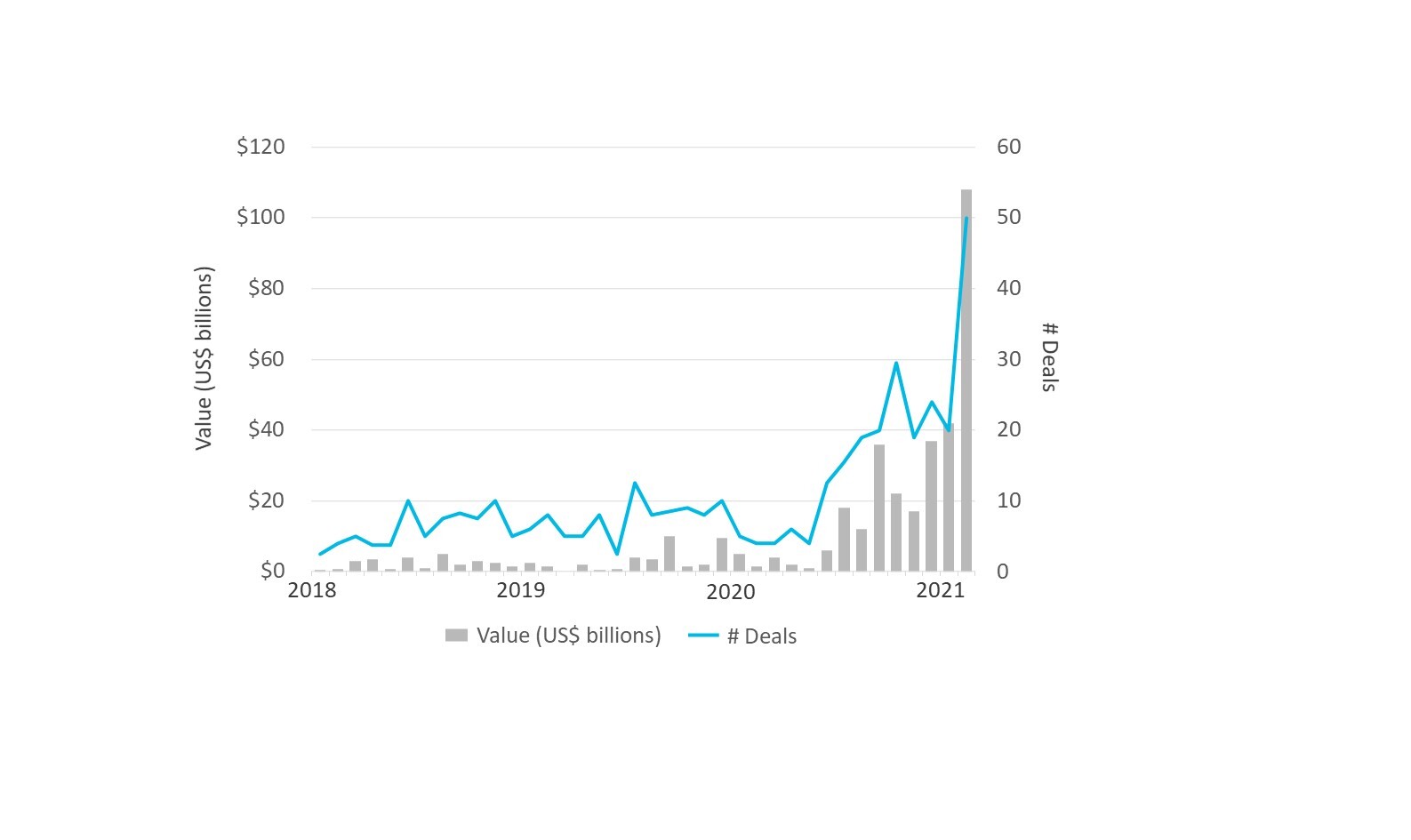

Special Purpose Acquisition Companies (SPACs) have also seen a surge in popularity over the past year. What is a SPAC? Think of it as a company that goes public via an Initial Public Offering (IPO) with nothing but cash in the bank. The reason for the company existing is to spend that money on “something” down the road once the management team is able to identify a business to buy. Once this company is found, investors can opt out for their initial investment (plus interest) or swap their SPAC shares for those of the merged company. What’s more speculative than handing your money over to someone who may grow it, but they don’t really know yet, how? Money is being handed over, though: Figure 4 shows the monthly volume of SPAC IPOs in recent years. Fifty deals raised over $100 billion in February 2021 alone.

Figure 4: Global SPAC Acquisitions, January 2018 February 2021

What is an investor to do?

Since the inception of Leith Wheeler nearly 40 years ago, there are a number of disciplines we have embraced to ensure our clients’ wealth is protected and grown prudently over time. By constantly revisiting each investment thesis, focusing on the quality of the underlying business, and being aware of our natural biases we can significantly reduce our exposure to speculative bubbles. There’s a reason you haven’t seen cannabis, Bitcoin or GameStop in your portfolio: we won’t buy shares of a company if we don’t trust the management, can’t rationalize the valuation, and don’t believe in the business model.

The following are a few tools we’ve developed over time to help us stay on track:

Subdue your biases. We are of course tempted by the same behavioural biases as everyone else. Being aware of those biases is a good first step, and our team-based approach helps us reinforce objectivity and remain accountable.

Stick to your investment discipline. As value managers, our investment discipline prioritizes quality businesses trading at a discount to our estimate of intrinsic value. In contrast to speculative bubbles, that means taking a view contrary to consensus as unloved or misunderstood businesses with good underlying fundamentals generally present the greatest opportunities to pay a lower price.

Leverage your superpower: time horizon. In addition to a focus on fundamentals, one of the key ways investors differ from speculators is time horizon. Our ability to look across a cycle gives us the confidence to buy a stock when others are abandoning it and hold it patiently until it hits new highs.

Diversify. Implicit in the time horizon argument is the benefit of portfolio diversification, which helps smooth returns over time. Diversification is a risk management technique that ensures your portfolio is made up of a variety of asset classes, and includes securities from various geographies, sectors, and industries.

The diversification argument brings me to an important final point on speculation. Portfolio diversification was truly my saving grace with Blackberry. The position made up a sliver of my overall portfolio and so I lost hundreds on the trade, not thousands. It still taught me a valuable lesson in that investment mistakes can be some of our best teachers, but only if we have other assets left with which to recover. A little bit of speculation won’t ruin a financial plan, and in some instances may even keep you engaged, and encourage active participation in your overall long-term financial planning.

With that said, it’s critical to set limits, ensure your portfolio is well diversified, and reach out to your portfolio manager if you are considering a new investment. If you would like help discussing these matters with other family members, we are always here.

IMPORTANT NOTE: This article is not intended to provide advice, recommendations or offers to buy or sell any product or service. The information provided is compiled from our own research that we believe to be reasonable and accurate at the time of writing, but is subject to change without notice. Forward looking statements are based on our assumptions, results could differ materially.

Reg. T.M., M.K. Leith Wheeler Investment Counsel Ltd.

M.D., M.K. Leith Wheeler Investment Counsel Ltd.

Registered, U.S. Patent and Trademark Office.