November 19, 2025 | Planning Matters | 6 min read

The True Costs of Entering Your Vintage Years

What is the first thing that comes to mind when you think of entering your retirement years? Do you see a tropical, sunny beach vacation, or maybe golfing with your friends? What most people don’t think about are the costs associated with advancing in age. In this article, I’ll explore the estimated costs of staying at home versus moving to a retirement community, some legal structures that can help protect your interests and finally, financial planning tips to ensure you have the resources to fund it.

Living costs in retirement

Retirement living costs can vary by type of care (i.e., part-time or 24/7 full-time care), location (i.e., by province, and city versus rural), and whether the facility is public or private.

Most seniors in fact prefer independent living. The costs associated with this choice are the typical everyday costs of rent/mortgage payments (if applicable), groceries, property taxes (if property is owned), strata fees (if applicable), utilities, and transportation costs. However, if one has health complications in advanced age that may require additional support, additional costs need to be budgeted for. A few are detailed in Figure 1.

Figure 1: Estimate of Home Care Service Costs

| Home Care Service | Hourly Rates | Weekly Hours | Monthly Cost* |

| Basic support and personal care | $25 to $30 per hour | 6 hours | $780 |

| Therapy Visits or Nursing | $50 - $60 per hour | 6 hours | $1,559 |

| Adult Day Programs | $65 per hour | 18 hours | $5,066 |

Source*: Guide to Retirement Home Costs. Note, on average demand can run from 4-6 hours/week up to 20 hours or more. 6 hours shown for illustrative purposes, grossed to monthly cost as: high end of hourly rate x 6 hours x 4.3 weeks.

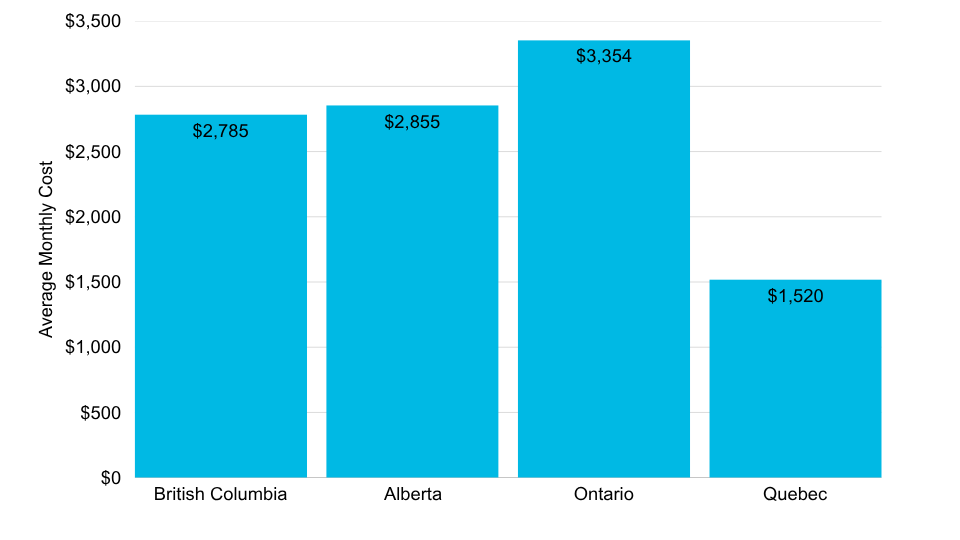

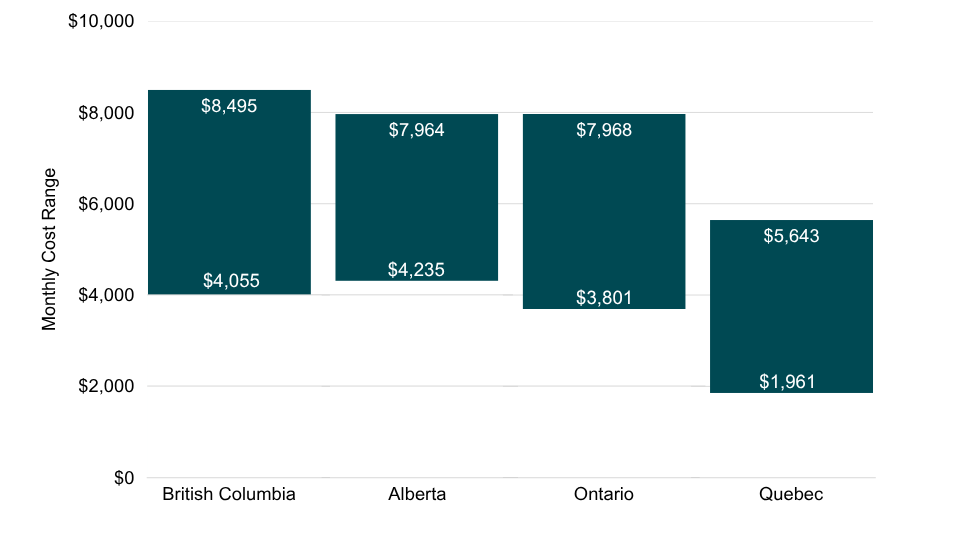

Whether by choice or due to health complications, some seniors choose to live in a retirement residence. Residences can provide a range of living and support options that range from independent living to assisted living, memory care, or respite care. Below are the costs separated into Public and Private. Public facilities (Figure 2) are run by a government/not-for-profit agency and Private ones (Figure 3) are owned by for-profit organizations who run retirement residences as a business.

Retirement Residences

Figure 2: Public Facility Living Costs by Province

Figure 3: Private Facility Living Costs by Province

Are there subsidies?

Many subsidies available for retirement residences are reserved for low income seniors who obtain public care. The subsidies are usually linked to the client’s after-tax income and apply a minimum - maximum range that the client is asked to contribute for these services.

As more seniors are living longer, there is a high chance the cost of senior living will go up. In the Census 2021 report, “A Portrait of Canada’s growing population aged 85 and older,” the authors predict that over the next 25 years (by 2046), the population aged 85 and older could triple to almost 2.5 million people. Currently, many provincial governments have rent controls in place, however, there is currently no legislation to control the cost of care (i.e., nursing, meal preparation). Therefore, some seniors are facing outrageous increases in their monthly bill as the operators of these retirement residences try to cover their own rising costs. As an example, a 2024 CBC article highlighted the story of one senior, whose cost to stay went from $2,452 a month to $3,405, a nearly 40% increase.

It will therefore be prudent when planning the cost of retirement living to use more aggressive inflation assumptions than the standard historical rates of 2 – 3%. As we enter a time where people are living longer, the cost to run these residences continue to increase, and the economic laws of supply and demand pressure rates upward, a more aggressive 8-10% inflation estimate may be more appropriate.

Solving the principal-agent problem

One conflict that can arise is when the person appointed to take over the financial affairs of a senior and ensure she lives comfortably, is themself an heir to the money used to fund that retirement. How do you ensure your needs (the principal) are not sacrificed to preserve the inheritance (of the agent)?

This issue is one you want to address early on. Here are some safeguards to consider putting in place so that you can enjoy retirement living, worry-free:

- Establish a living trust – This will ensure that you can create clear directives within the trust to let your inheritors know your wishes while allowing the assets in the trust to pay for your care. You can appoint the trustees – whether it be members of your family that you trust (to act jointly) or to hire a professional fiduciary – to follow the instructions within the trust so no inheritor will be able to withhold care to retain a larger share of your assets.

- Power of Attorney – Similarly, you can appoint a professional fiduciary to handle decisions for you as a neutral third party so that they act in your best interests, as opposed to a beneficiary with a different agenda making decisions on your level of care.

Engage an Eldercare Consultant – These are third party service providers you can engage to discuss all things related to elder care planning. They can help you put safeguards in place so that potential beneficiaries do not reduce the level of care you require in order to have a bigger piece of the estate pie.

Financial planning for retirement expenses

Planning for retirement living expenses is not dissimilar from building a family budget or researching and saving for a big vacation. You need to estimate the expenses, determine how to fund them, and then do annual reviews to confirm the plan is still on track (or needs amending). Various DIY budgeting tools exist, from the big banks to ChatGPT, or you can engage with a Certified Financial Planner (CFP) like myself. I work with clients to build a detailed projection of their retirement living costs and figure out tax-efficient methods to draw income to pay for it.

A Financial Plan would look at:

- Creating a Retirement Projection and Determining Income Sources – We would assess the different sources of income to fund the projected retirement living expenses, and help you determine when to take CPP or OAS to get the maximum benefit suitable for your situation. Working with your Portfolio Managers, we also review your RRSP/RRIF, TFSA and non-registered assets to see how much income we can draw annually from your investment portfolio.

- Risk Management – We review and consider insurance options, including Long Term Care Insurance or Critical Illness Insurance, so if a health complication occurs, you won’t need to draw down your assets to pay for this unfortunate event.

- The Role of Your Principal Residence – We look at strategies to use what may be your largest asset to fully or partially fund your retirement expenses. Options could include downsizing or using your home to secure a Home Equity Line of Credit.

- Tax Planning – We work with your accountants to maximize your medical expense tax credit, disability and caregiver credits so that these expenses are funded tax efficiently.

A good CFP will look at your decision through a holistic lens and help you clarify your goals, values, and purpose to align with the financial matters at hand. As there are costs to consider beyond the financial when deciding whether to move into a retirement residence, it’s important to weigh the pros and cons of each. Only then will you have the peace of mind that you have made a decision that will align with what makes you unique, throughout your vintage years.

NOTE: The information contained herein should not be treated by readers as legal advice and should not be relied on as such. We suggest you seek legal advice for your personal situation.

About the Contributor

Kenald Yu is a Certified Financial Planner (CFP®) at Baker Tilly WM LLP with a focus on helping clients achieve their life goals through the process of financial planning. He helps those in transition with a major life decision such as changing jobs and/or careers, purchase and/or sale of real estate, transitions to and preparation for retirement, retirement income planning, planning for a business sale, insurance planning, estate planning, and intergenerational transfer of wealth to heirs or organizations/causes dear to the client's hearts. He can be reached at Kenald.yu@bakertilly.ca.