July 06, 2020

What does Canada’s AAA Downgrade Mean?

On June 24, the rating agency Fitch downgraded Canada’s long-term debt rating from AAA to AA+, citing a deterioration in government finances due to fiscal policy in response to the coronavirus pandemic.

The downgrade was not entirely unexpected, since Canada has been on “negative outlook” for Fitch since April 2020. Canada has been AAA-rated by all four rating agencies since 2004 (Fitch, plus Moody’s, Standard & Poor’s, and DBRS), and the other three have maintained their AAA-ratings with stable outlook.

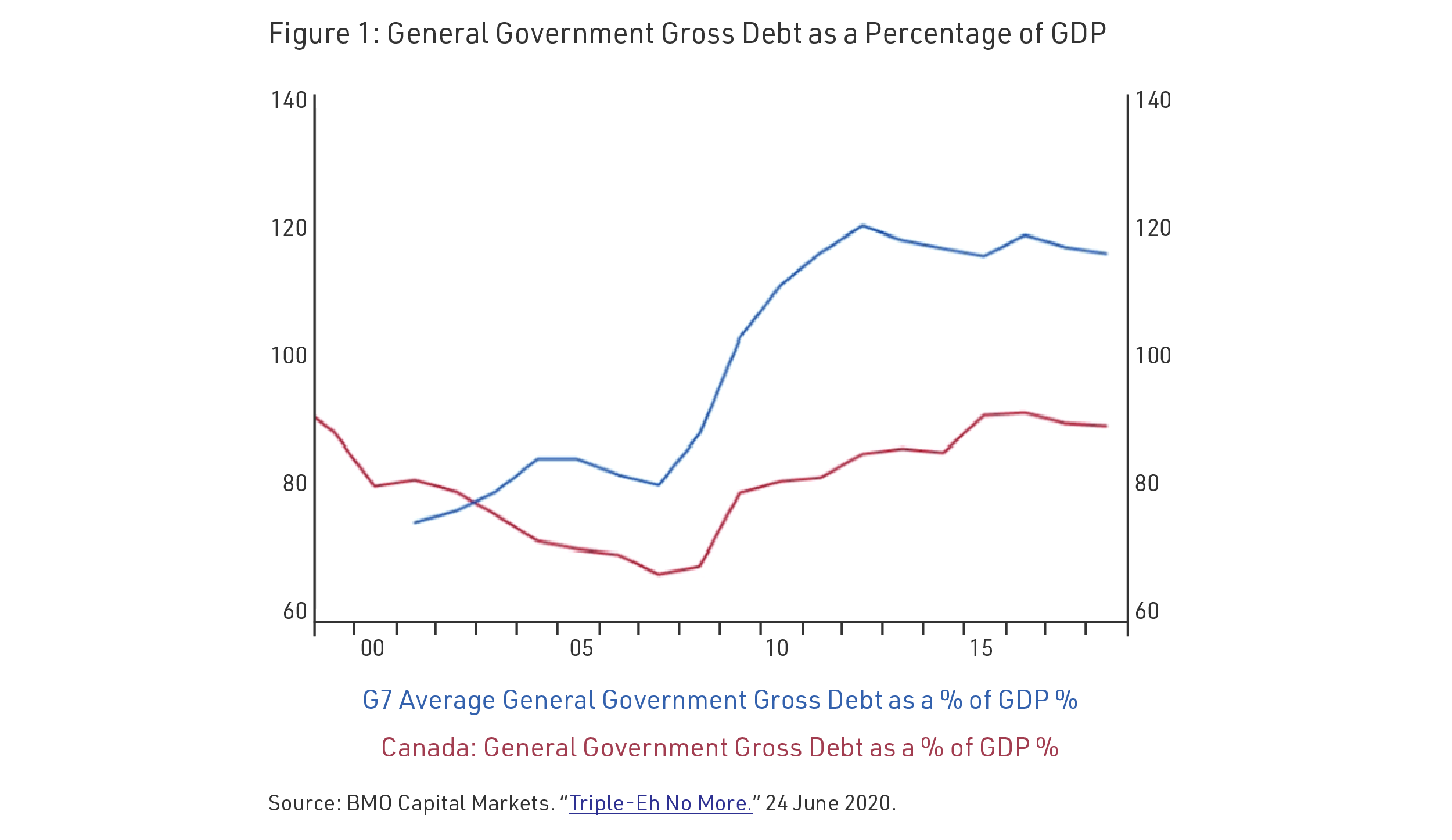

Importantly, Fitch considers the aggregated level of government debt across Federal, Provincial and Municipal governments when rating a sovereign entity, which for Canada Fitch expects to increase from 88% to 115% of Gross Domestic Product (GDP) based on the fiscal response so far, and the expected 7% GDP decline in 2020. However, Canada remains in a relatively strong debt position compared to other advanced economies. For example, the International Monetary Fund calculates gross debt/GDP for Canada to be 109.3% by the end of 2020, compared to the advanced economies average of 131.2%.

Following the downgrade, there are now only eight countries that are AAA-rated by all four rating agencies: Denmark, Germany, Netherlands, Sweden, Switzerland, Norway, Singapore, and Australia. Of these eight, only three have 10-year government bonds with positive nominal yields.

Investment Implications

Overall, we believe that the downgrade is unlikely to have significant investment implications for the Canadian economy and financial markets – particularly the yields on Government of Canada bonds. Although a downgrade would typically be viewed as negative for Canadian bonds, there are far more factors to consider. As a fiat currency issuer, the Canadian Government will always be able to repay its debts through monetization (i.e., issuing new Canadian dollars).

Furthermore, recent dramatic interventions by the Bank of Canada and other global central banks mean that interest rates and government bond markets do not necessarily reflect changes such as a downgrade to the sovereign credit rating in the same way. The reaction to the downgrade in capital markets has therefore been understandably muted.

However, there are several important implications from this downgrade that have the potential to impact fixed income investment portfolios:

1. Provincial Credit Ratings

Ratings agencies generally prefer not to have Provincial governments assigned a higher rating than the Sovereign / Federal Government. This is because the Federal Government implicitly guarantees Provincial borrowing and would be unlikely to allow a Province to outright default, without offering some form of assistance.

We therefore believe that this puts the Province of British Columbia’s AAA-rating at risk. Standard & Poor’s has already put British Columbia on negative watch, while DBRS has already assigned a AA-rating to British Columbia. We would therefore expect to see Fitch (and potentially other agencies) downgrade British Columbia in the near future.

2. Capital Flows

Foreign investors hold C$1.5 trillion in Canadian bonds, with only C$200 billion of this invested in Federal government bonds and the remaining $1.3 trillion invested in Provincial and Corporate bonds. Despite the substantial increase in government borrowing as a result of the fiscal response to the coronavirus pandemic, foreign investors added C$49 billion, an all-time record. In addition, the Canadian Dollar has rallied against both the US Dollar and on a trade-weighted basis since the end-March. In our view, foreign investors in the Canadian bond market do not appear particularly concerned about the recent budget deficits and rising government debt levels.

However, we are continuing to watch foreign capital flows very closely for signs that the large foreign reserve holders are moving away from Canada. Canada represents only 1.9% of foreign reserve assets, which hardly represents a significant sovereign risk to these portfolios. Furthermore, all other AAA-rated countries with positive yields combined account for only 4.5% of holdings. Nonetheless, the sheer size of foreign reserves makes any portfolio divestment significant to smaller, open-market economies such as Canada. In addition, the potential impact that a reversal of such flows could be significant on both Provincial and Corporate bond spreads.

3. Portfolio Constraints

Many Canadian investment portfolios have a prescribed minimum average credit rating within their investment policy statement. Although Canada has been downgraded by Fitch, it retains an average credit rating of AAA, since three of the four issuers remain at AAA. However, if another ratings agency were to downgrade Canada to AA, the resulting two AAA and two AA ratings would in combination be considered AA-rated for the purposes of the FTSE Canada Universe Bond index and our own Leith Wheeler rating framework. Since Federal government bonds represent approximately one-third of the outstanding bonds in Canada, a downgrade by one of these three agencies could have a material impact on a portfolio’s average credit rating, and trigger forced selling of other AA-rated provincial and corporate bonds.

Looking ahead, Canada has a fiscal update on July 8, after which the ratings agencies are likely to provide any updates to their credit assessments. As mentioned above, none of the other three agencies currently has Canada on negative watch. We believe that of the remaining three rating agencies, a downgrade from Standard and Poor’s would be the most significant as they cover the most Canadian public issuers and have international recognition.

In our view, Canada is facing the same challenges as the rest of the world in response to the pandemic – we have hardly exceeded our budgets in isolation. Comparisons to the recession in the early 1990s that led to Canada initially losing its AAA rating from Standard & Poor’s in 1992 and later Moody’s in 1994 are not justified, in our view. Canada entered this recession in a much more favourable fiscal position than in the early 1990s, and the current recession is expected to be relatively short-lived due to its cause being an exogenous shock rather than financial imbalances and excesses that need to be unwound. Should the current crisis response morph into more permanent fiscal imbalances, this would be cause for concern. However, despite the uncertain future, we remain of the view that Canada’s longer-term fiscal discipline remains intact.

Recent Posts

- Resources for Reconciliation

- Leith Wheeler: Investing in Women

- WEBINAR: Leith Wheeler in Québec

- In Conversation with Julia Chung: Advice for Your Golden Girls Era

- Leith Wheeler Establishes Montréal Office, Hires Industry Veterans Eric Desbiens and Denis Durand

- VIDEO: Leith Wheeler Outlook 2025

- WEBINAR: Home Country Bias

- Section 899: A New Cross-Border Tax Threat for Canadian Investors?

- Leith Wheeler Explainer Series: Trade Deficits

- The Leith Wheeler Podcast Playlist