February 04, 2024 | Quiet Counsel | 8 min read

Outlook 2024: Threading the Needle

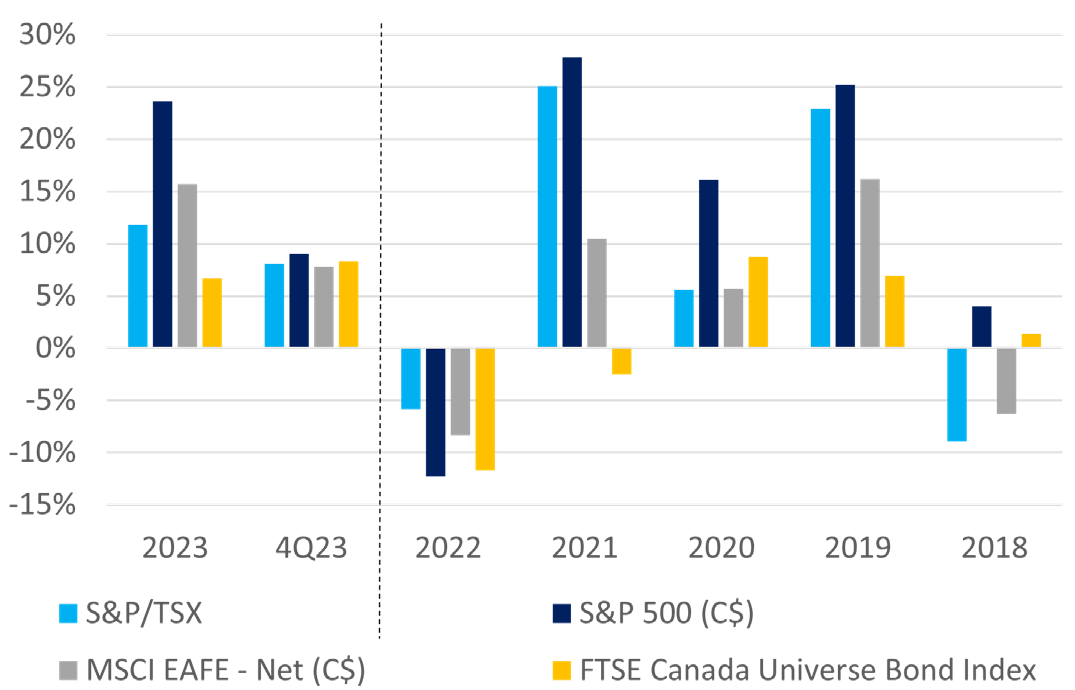

It has been a volatile few years in capital markets. Both equity and fixed income portfolios posted strong returns in 2023, with significant help from a fourth-quarter rally that boosted modest (non-US) equity returns and saved bond markets from another negative year. The year also provided a significant turnaround from 2022, when investors were left in shock as stock and bond returns were simultaneously in the red for the first time in two decades.

Figure 1: Capital Market Returns, 2018 – 2023

Over this period, we’ve counseled calm – including when markets were selling off after the Federal Reserve’s aborted attempt to hike interest rates in 2018, when COVID wiped nearly 30% from markets in less than a month, and after 2022’s interest rate tightening cycle was launched to battle inflation – assailing equity and bond markets alike. We quoted the Sufi poets that “this too shall pass,” neither good nor bad moments last forever. So, too, in investing – staying the course and remaining invested is what matters most. As Figure 1 illustrates, selling into down markets would have cost investors significant upside.

As a reminder, in our two-part Outlook series last year (here and here), we described the relationship between inflation and the valuation of financial assets: namely, that inflation and central banks’ efforts to combat it through interest rate hikes tend to trigger a “reset higher” in bond yields (lowering bond returns). Because those bond yields are then used as an input by the stock market to discount future cash flows, stock prices tend to fall as well.

We now believe the majority of this reset higher in bond yields has run its course. Although prices for goods and services are clearly higher than a few years ago, the rate of change in prices (inflation) has slowed significantly from its peak. Despite resilience in (particularly US) economic growth towards the end of 2023, the expectations of central banks have finally shifted from “hiking” to at some point “cutting,” possibly by mid-2024. Monetary easing may finally be back on the table.

It should be noted that this has been a precarious balancing act for policymakers, who have had to meticulously thread the needle of constraining growth to arrest inflation, without pitching us into deep recession. The consensus view today of a soft economic landing and moderating inflation to long- term targets is remarkable (and could potentially prove optimistic).

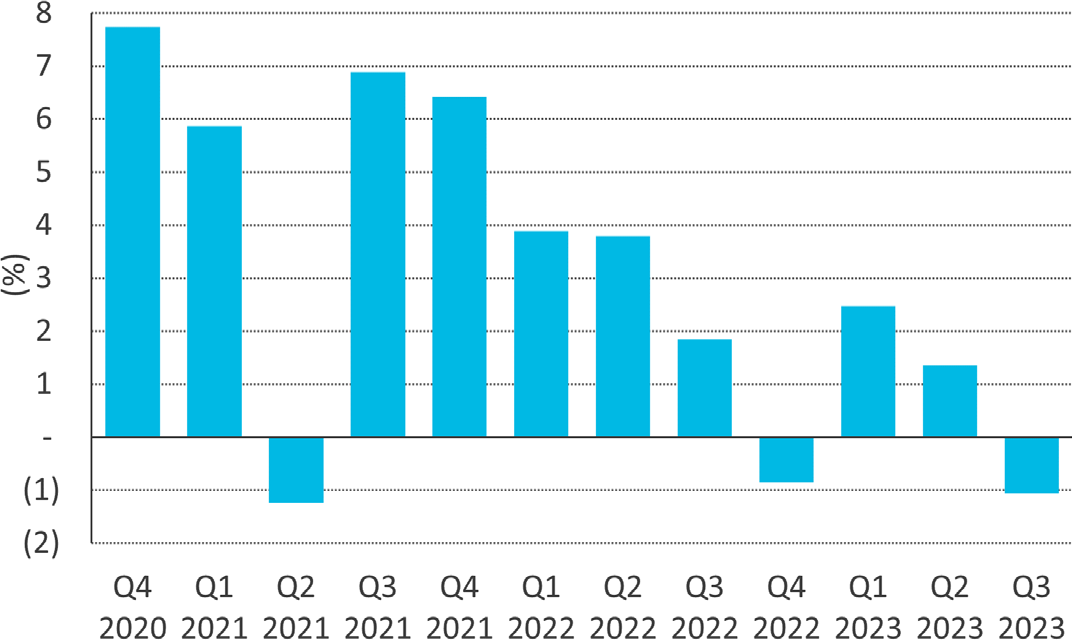

Figure 2: Economic Growth Has Slowed – Canadian Quarterly GDP, Annualized

Continued disinflation and economic growth should be a tailwind for both equities and bond returns in 2024, however market returns will also be a function of actual monetary policy. Those cuts aren’t in the bag yet. Most pundits are calling for a slowdown in the first half of 2024, but there is considerable uncertainty around this forecast. While Canada has already slowed significantly, US headline numbers are chugging along (though it arguably experienced a “rolling recession” in 2023, in which several industries contracted at different times without triggering a broad-based contraction in the overall economy).

Regardless of the magnitude of any cuts to policy rates, we believe that higher (read: more normal) interest rates are here to stay. This is due to a rise in what’s called the “equilibrium level” of real interest rates due to a combination of factors including demographic changes, immigration, productivity growth, and higher structural fiscal deficits (driven in part by higher global defense spending). In addition, the recent decline in inflation could be stalled longer-term by countervailing forces such as the transition to clean energy, as well as changes to industrial policy such as “nearshoring” in global supply chains (i.e., building out domestic production instead of relying on imported – cheaper – goods).

There are several reasons to be positive on the outlook for investment returns in 2024.

In interest rate markets, the starting yield on Canadian government bonds remains elevated at approximately 2% above long-term inflation expectations. This reflects a much more “normal” set of market conditions following the 15+ years of abnormal bond markets that followed the Great Financial Crisis. In fact, this is better than normal, as 2% real yields represent the most attractive levels for bonds in several decades. Higher bond yields also provide protection against fluctuations in interest rates, dampening volatility and improving risk-adjusted returns in a balanced portfolio.

In credit markets, the overall level of credit spreads (i.e., the premium investors require to own corporate or other bonds that carry some level of default risk) remains reasonable in comparison to long-term levels, particularly among the higher quality, investment-grade credit issuers. We think high yield credit markets look more expensive at current levels, while the leveraged loan market looks particularly unattractive right now. Leveraged loans usually carry lower default risk than high yield bonds but companies issuing in this segment have been hard hit by central bank interest rate hikes due to their higher exposure to floating rate debt.

Meanwhile, fundamentals overall are also encouraging. Refinancing in the immediate aftermath of the pandemic was effective in improving balance sheets and pushing out maturities, and the recent decline in expectations for short term policy rates will ease pressure on those companies with more acute refinancing pressures.

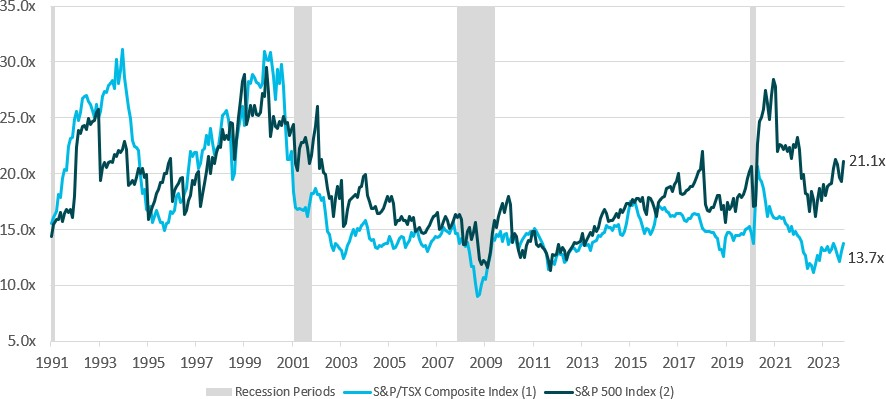

In equity markets, we believe stock prices appear reasonable, even after their late-2023 surge. The stabilization of interest rates and improving outlook for cuts seems to have taken some pressure off of stock valuations.

In Canada, overall market multiples have been subdued by a more cautious outlook for the banks. We remain positive on the sector, however, and believe the pessimism about growth and credit quality are largely reflected in current prices. With as much as a 10% discount to historical multiples, the banks have room to revert to mean. We also continue to find ample opportunities to invest in quality companies with a demonstrated ability to compound capital over time.

Figure 3: Equity Valuations Still Reasonable – Forward Price/Earnings Ratios for S&P/TSX and S&P 500 Indices

Source: RBC, Factset, Bloomberg as of December 31, 2023.

- Prior to 2001, the S&P/TSX forward P/E is sourced from RBC; thereafter from Factset.

- S&P 500 Index forward P/E is sourced from Bloomberg.

Outside of Canada, valuations appear similarly modest, with the exception of select US large cap stocks. Valuations in this new market subset, known colloquially as “The Magnificent Seven,” have boosted the average multiple for large cap stocks and made US equity indices (and the passively managed portfolios that mimic them) more concentrated now than they were, even at the height of the dot-com bubble. However, the broader US equity market, including US small-cap and mid-cap equities, remain at more reasonable valuations, particularly when considering the resilience of the US economy in the face of tighter monetary policy, which is expected to ease going forward.

Global economic growth has proven to be much more resilient than most expected in 2023, boosting expectations for corporate earnings growth in 2024. This has been partly an AI-driven story impacting specific stocks, however the benefits of AI to productivity and corporate earnings for a broad set of companies over the next decade could be significant. In Canada, economic growth has been more anemic in 2023, particularly after adjusting for the positive impact from record immigration inflows, but we also think valuations in Canadian equities are more attractive than other regions.

Finally, while cash has undeniably been an attractive place for investors with its high short-term yields and stability during periods of market volatility, we think that the year ahead should provide better investment opportunities elsewhere. Indeed, those who opted for GICs in the fourth quarter of 2023 will have been reminded of the downside of trying to time the market – as both Canadian core bond and balanced portfolios returned 8-9% over that three-month period.

Risks

Our constructive view for capital market returns in 2024 should, however, be tempered by a rising number of exogenous risks. The below list is not intended to be exhaustive, but rather to highlight some of the areas of concern that we continue to watch closely:

- A desynchronization in global growth and inflation, particularly in China where deflationary pressures and weak consumer confidence are expected to slow economic growth to 4.5% in 2024, well below trend growth over the past decade.

- As Figure 4 shows, a global election super cycle is expected in 2024, including 64 countries (plus the European Union), that represents a combined approximate 49% of the global population.

Figure 4: Countries Around the World Holding Elections in 2024.

The most important of these to capital markets will undoubtedly be the US presidential election in November. While historically markets have tended to do well irrespective of which party wins power, Republican and Democrat candidates are currently telegraphing wildly different policy intentions, particularly in relation to expiring tax cuts – which could have a significant impact on US fiscal stimulus in 2025 and beyond. - A marked rise in geopolitical risk, with hot regional conflicts in both Ukraine and the Middle East potentially escalating into broader conflicts involving other countries (Iran and China, most notably, though a decision by the latter to insert itself would arguably run counter to its economic interests). It should not go unmentioned that both conflicts are occurring in commodity- producing regions, elevating the risk of an oil or other commodity shock. Furthermore, rising tensions in Taiwan and Korea represent additional potential geopolitical entanglements. While history shows that 90% of geopolitical events have not changed the direction of the world economy, we think it prudent to incorporate the rising frequency of such events into a risk framework for investing.

- Sustained fiscal deficits are driving a shift higher in the net supply of government debt to levels not seen in three decades. Meanwhile, central banks that have historically acted as the buyers of last resort, have become net sellers. This move may have the effect of keeping longer-term bond yields elevated, even in the event of a decline in short-term interest rates.