February 16, 2018 | Quiet Counsel | 8 min read

Reefing the Main: Our Tempered Investment Outlook for 2018

An old sailing adage states that “the time to reef is when you first think of it.” Reefing is the practice of reducing the area of your sail in anticipation of rough weather. You will seldom regret reefing early and you will almost always regret reefing late.

In our view, this metaphor is very well suited to today’s investment landscape as at the end of 2017, we put a reef in our balanced portfolios by reducing our recommended equity weight to neutral for the first time in over a decade. We see the potential for rough weather rising on the horizon that is not reflected in current prices.

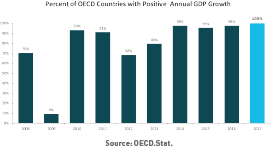

To be clear, there are still many positives factoring in to our current investment outlook. The global economic recovery has strengthened and has broadened to include many emerging market economies that were in deep recessions just a few years ago. In fact, for the first time since 2007, all 45 countries tracked by the Organization for Economic Cooperation and Development (OECD) are on track to grow in 2017, and growth in roughly three quarters of these economies is accelerating. The United States, which led the global economic recovery, has now successfully passed major corporate tax reform with a pro-business and deregulatory agenda. Meanwhile Europe, which suffered almost a decade of literal— existential concerns, is now the lightning rod for optimism.

"What does the market think the global economy will do, and has it priced it “for perfection”?"

Furthermore, low rates of core inflation particularly in the developed market economies suggests that interest rates should remain low at least over the short-term, even if some central banks are starting to raise them.

We would not, therefore, describe equity or credit markets necessarily as either euphoric or in “bubble” territory. A case can be made to support valuations in these asset classes, particularly in an environment of low interest rates.

But as long-term investors of our clients’ capital, we need to look further out on the horizon. So what do we see that is making us concerned enough to reduce our equity exposure?

The first cause for concern is the indifference to risk currently embedded in investor psychology, and the profound effect that’s having on the (high) prices people are willing to pay and the (more aggressive) ways they are splitting up their portfolios.

The “risk on” mentality is to a large extent the direct consequence of a decade of low interest rates, which by its very design is intended to lure investors into more productive, higher yielding (and riskier) projects. The most obvious effect has been with regard to equity market volatility. Last year, equity markets experienced unprecedentedly low volatility, with the S&P 500 posting positive monthly returns in every calendar month something that has never happened in the 89-year history of the index. This was accompanied by the lowest expectations for future market volatility in the 30-year history of the Chicago Board Options Exchange’s volatility index (VIX) contracts. Prices have been rising in a worryingly orderly way.

Credit markets have exhibited similar characteristics. For example, high yield bond credit spreads, the premium demanded by the market for taking on the risk of default from lower-quality issuers, are trading close to the lowest levels since 2007. In addition, most high yield bond issuers are successfully raising money without having to put in the kinds of protective language normally required by investors for the risk they carry. These “covenant-lite” issuances tend to appear late in the credit cycle. Despite low spreads and a lack of protective covenants, new issuances continue to attract significant demand, with Tesla recently raising US$546 million in a multi-tranche deal that saw some tranches generate demand 14 times the amount on offer.

The second cause for concern is our assessment of the probability for fundamentals to perceptibly deteriorate from their current, and importantly strong, levels. We use the term “probability” because it is nearly impossible to predict what such a complex set of interdependencies as our global economy will do with any certainty. Rather, as long-term investors, we look at the range and distribution of possible outcomes, and compare these with current fundamentals and the market’s assessment for future fundamentals that is embedded within asset prices. In short: what does the market think the global economy will do, and has it priced it “for perfection”?

That assessment doesn’t rule out the chance that the global economy will continue to accelerate, but the chances are now elevated that some factor a moderation in economic data, a policy misstep, an inflation scare, overly aggressive monetary tightening, or some geopolitical or other risk reshapes the currently strong set of expectations lower.

Put another way, when all 45 countries tracked by the OECD are growing at the same time, the risks naturally become more skewed towards one or several of those countries faltering at some point.

The risk factor that concerns us the most is the impact of rising interest rates on asset valuations. Ironically, our concern here is less about the impact on the bond market than on other asset classes.

At its core, every asset or investment is simply a prepayment for future cash flows. Those cash flows could come in the form of dividends, rental receipts, royalties, bond coupons, or some future principal repayment that might include capital appreciation. The entire investment market values these future cash flows based on the risk-free government bond yield curve. And as rates increase across that curve, the value today of those future cash flows decreases in value. Right now, we expect those rates to rise.

Our macro outlook includes expectations of a combination of rising inflation, a sharp tightening in the labour market, the unwinding of central bank balance sheets, and the decline in global over-the-counter bond market liquidity.

"The best most successful investors can hope for is to be right on direction and not too wrong on timing."

And while these factors all point to higher government bond rates, we cannot be sure how bond markets will react, or when. Most importantly, since these government bond rates are used to value all investment assets, our level of uncertainty (and caution) in regard to both equity and bond investment has risen materially in the past few years.

That uncertainty leaves us with two important questions that we are often asked by clients: 1) What is your view on equity and credit markets from here, and 2) How should our portfolios be positioned?

Most people are looking for their investment manager to provide a definitive view on whether markets are going up or down, but unfortunately markets are just not that simple and rarely serve up such transparent, tradeable “inflection points”: the best most successful investors can hope for is to be right on direction and not too wrong on timing. Markets instead should be viewed as the complex clearing mechanisms they are, where optimistic buyers and exasperated or cautious sellers come together to trade. And those trades reflect in addition to the fundamentals of the securities in question each trader’s place along a continuum of fear and greed, factors of the uniquely human variety that defy explanation or prediction and only rarely reach extremes of hubris or hysteria. The question is therefore more where within this continuum we reside in our thinking, and accordingly where our client portfolios should be

positioned.

Over the past 10 years, our clients’ balanced portfolios have been at the moderately more optimistic end of this spectrum, reflected with an overweight position to both equity and credit markets. This is a strategy that has served our clients well and enhanced investment returns over the past decade, but that was then. This is now.

What we are confident of is that equity market returns over the next decade will likely be lower than over the past decade, and will likely occur in an environment of higher volatility. Expected returns from equity markets have to be lower when starting from price-earnings multiples that are high relative to the long-term average. To deny it would be to assert that markets are not mean-reverting, and that somehow “it’s different this time.” But facts differentiate stories from history. Here are some facts on the historical “Next 10 Year” performance of equity markets, from various starting levels of index valuation (P/E multiples).

The credit crisis, 10 years old this year, brought the S&P 500 to a multiple of 12x forward earnings and subsequently gave us total returns of almost 12 percent per year. The S&P 500 forward P/E is currently in the range of 19x. History therefore suggests more modest equity returns going forward.

In fixed income, bond and credit market returns naturally benefit from declining yields and spreads, and as discussed both are significantly depressed versus long-term historical levels, lowering their range of potential returns as well.

Given our confidence in our assessment, we felt it was prudent to reduce equities in the fourth quarter of 2017 and thus position our clients’ portfolios to be more conservative than we have over the past decade.

While we were in the process of publishing this article, both stock and bond markets have softened. The S&P/TSX Composite is down nearly four percent so far in February and the S&P 500 is down five. Bonds have fallen, too, with the FTSE TMX Universe Index losing 0.68% on the week as rates have risen (10-year Government of Canada bond yields are up 0.17%).

Irrespective of our overall market view, the most important work we do at Leith Wheeler continues to be at the company level. Making good investment decisions for our clients remains rooted in taking the time to find businesses we like, with skilled executives, that are trading at low valuations because they are either out of favour or have prospects that are underestimated by the market. It’s what has helped our clients, and us, to be successful for the past 35-plus years, whether reefing into storms or cruising out of them.

IMPORTANT NOTE: This article is not intended to provide advice, recommendations or offers to buy or sell any product or service. The information provided is compiled from our own research that we believe to be reasonable and accurate at the time of writing, but is subject to change without notice. Forward looking statements are based on our assumptions, results could differ materially.

Reg. T.M., M.K. Leith Wheeler Investment Counsel Ltd.

M.D., M.K. Leith Wheeler Investment Counsel Ltd.

Registered, U.S. Patent and Trademark Office.