February 17, 2023 | Quiet Counsel | 4 min read

Outlook 2023, Part II: Recession, Bonds, and Equity Markets

In Part I of our two-part Outlook series, we concluded that inflation was likely to continue to decline, and that interest rate hikes were probably in the final innings. In Part II, we explore the impact on the economy and capital markets.

Will we get a recession?

While our base case continues to be for a mild recession in Canada, stubbornly high inflation has pushed expectations for the terminal rate higher, increasing the risk the recession cuts deeper.

Timing wise, however, we do not see major warning signs of an imminent recession. While economic indicators such as retail sales and employment have slowed, the factors that would make us more concerned such as rising debt default rates, tougher access to credit, or a collapse in asset prices haven’t materialized. The Canadian housing market is clearly cooling off with modest price declines and a sharp slowdown in activity and sales, but the indicators of distress that might be reminiscent of 2008 in either the real estate market or the financial sector are just not there.

Overall, the moderation in inflation is likely to help support capital markets, both fixed income and equities. As an investment manager, we are primarily concerned with identifying those markets or securities where prices are not consistent with our assessment of value.

Fixed Income Outlook

In fixed income, the market currently reflects an expectation that central banks will begin cutting interest rates again as early as late 2023. We think this premature. Similarly, we think the Bank of Canada’s recent forecast of a return to 2% inflation by year-end is overly optimistic. If inflation does remain elevated, it will restrict the Bank of Canada’s ability to cut interest rates if the economy falls into recession.

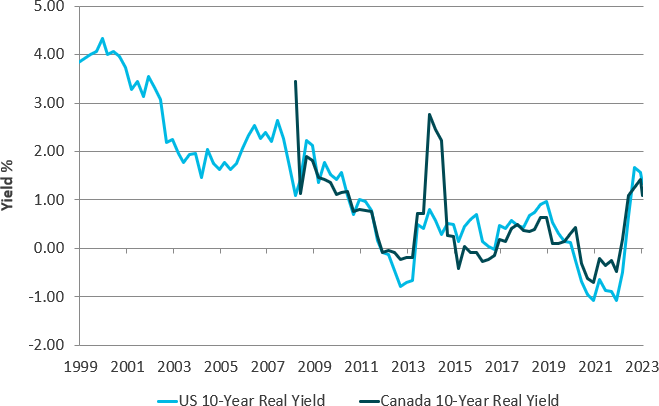

For investors in longer-dated government bonds, the rise in bond yields has meaningfully improved forward-looking return expectations, and we take particular comfort that the real yield offered by bonds (net of inflation expectations) is now firmly positive after more than a decade where they bounced either side of zero (see Figure 1). Finally, credit markets remain attractive to investors who are seeking higher all-in yields, given the improvement in corporate balance sheets a benefit of refinancing activity that happened, post-pandemic.

"Overall, the moderation in inflation is likely to help support capital markets, both fixed income and equities."

Figure 1: Canadian and US real yields, 1999-2022

Overall, the moderation in inflation is likely to help support capital markets, both fixed income and equities.

Equities Outlook

The outlook for equity markets is more nuanced. While our view is valuations now largely reflect the higher discount rate, what is less certain is the impact of any earnings slowdown. As discussed in a recent article, our Value style has performed well over the past couple of years as investors’ confidence in the future cash flows of Growth stocks declined, and a higher discount rate made things even worse for them. By contrast, companies that generate solid earnings and possess a strong economic moat – like the ones in our equity portfolios – have fared better. We believe the Value advantage will persist for some time as hubris continues to be wrung out of high flying technology and other stocks, and interest rates settle in to a “normal” rate that is higher than zero.

Conclusions

While Canadians are still adapting to higher prices, our view is that inflation likely peaked last summer. At Leith Wheeler, we expect an orderly decline toward the Bank of Canada’s long-term target of 2% but we don’t think it will come as early as this year. We similarly feel interest rates will be kept higher and for longer than the market is currently reflecting.

We believe valuations for stocks and bonds have largely incorporated the pain of the recent interest rate hikes, but markets are likely to remain volatile for a few reasons. High levels of uncertainty in the outlook for inflation and economic growth – including recession fears – is at the forefront. While investors debate the severity of a potential recession, the indicators we watch suggest it will most likely be a mild one. However, should core inflation remain elevated, the Bank of Canada may be forced to keep short-term interest rates high, even if growth slows significantly.

We invest for the long-term for our clients, so we don’t spend a lot of time debating the nuances of whether these trends will come to pass in the short or medium term. Over the next 10+ years, our assumptions for capital markets are for a core diversified bond portfolio to deliver returns of around 4%, and equity markets in Canada and globally to deliver around 7% over the long-term.

Through this cycle, as in past ones, we will apply our Value investing discipline as we believe buying high quality businesses at discounted prices (as many trade at today), and holding for the long term, offers investors the greatest opportunity for success.

IMPORTANT NOTE: This article is not intended to provide advice, recommendations or offers to buy or sell any product or service. The information provided is compiled from our own research that we believe to be reasonable and accurate at the time of writing, but is subject to change without notice. Forward looking statements are based on our assumptions, results could differ materially.

Reg. T.M., M.K. Leith Wheeler Investment Counsel Ltd.

M.D., M.K. Leith Wheeler Investment Counsel Ltd.

Registered, U.S. Patent and Trademark Office.