August 15, 2022

Leith Wheeler Explainer Series: How to Maximize Your RESP

Registered Education Savings Plans (RESPs) are an excellent way to provide for the future of your child or grandchild’s post-secondary educational expenses. Not only do they create a discipline for saving, they also allow you to benefit from market growth over many years, tax-free.

While most Canadians seem to have a general idea of how they work, we wanted to focus here on some lesser-known strategies you can employ to maximize the benefits of the RESP, as well as some of the potential pitfalls to avoid.

RESPs 101: What are they?

An RESP is a special account you can set up for your child, designed to get parents saving early for their post-secondary expenses. The government incentivizes the behaviour by doing two things: permitting the money to grow tax-free while it’s in there, and offering grants to match up to 20% of contributions in a given year (subject to maximums).

An additional benefit is when the funds are eventually withdrawn, the payments are taxable in hands of the beneficiary, and only apply to grant funds and growth (not your contributions). As we know most students tend to make little to no income while in school, this withdrawal can often be made tax free.

What to do with your RESPs

Start contributing early. An RESP can be opened in the year of birth of the beneficiary and starting contributions early will allow you to maximize the compounding growth effects within the account. The additional benefit is you will start receiving the Canada Education Saving Grant (CESG) – free money from the federal government (covered below) – at an earlier age as well, further increasing the compounding effect. The lifetime contribution limit for RESPs is $50,000.

Maximize the Canada Educations Savings Grant. The most common government matching program is the basic Canada Education Savings Grant, which has the potential to provide an additional lifetime total of $7,200 per beneficiary. The federal government will match 20% of your first $2,500 in RESP contributions each year, up to an annual maximum of $500.

One nice feature is if you miss contributing to the RESP in any given year, the CESG room is carried forward so you have the ability to catch up. It does come with limitations, however, in that you can only catch up one year at a time with a maximum CESG payment of $1,000. This would require an annual contribution of $5,000 to achieve.

For example, if your child is 4 years old and you haven't started contributing to an RESP, you can contribute $2,500 immediately to obtain the initial $500 in basic grant funds. You can then contribute a further $2,500 to capture part of the carry-forward, but you will have met the $1,000 annual maximum grant payment. Any further catch-up will need to be addressed in the following calendar year.

Don’t wait too long to get started. Waiting too long may in fact make it impossible to fully catch up once the beneficiary reaches the age of 11 – with only seven years left the most you can get will be $1,000 benefit per year if you put in $5,000 every year. The maximum available benefit just reduces from there[i].

Access additional funding if you qualify for them. In addition to the Basic CESG, there are two additional programs that offer post-secondary funding based on economic need: Additional CESG (max $50-$100 per year) and the Canada Learning Bond (lifetime max $2,000).

Let’s see how these might play out through some examples. Virginia is born in 2022 and her parents are considering how to help her attend a post-secondary institution many years down the road. Here are a few scenarios that could play out:

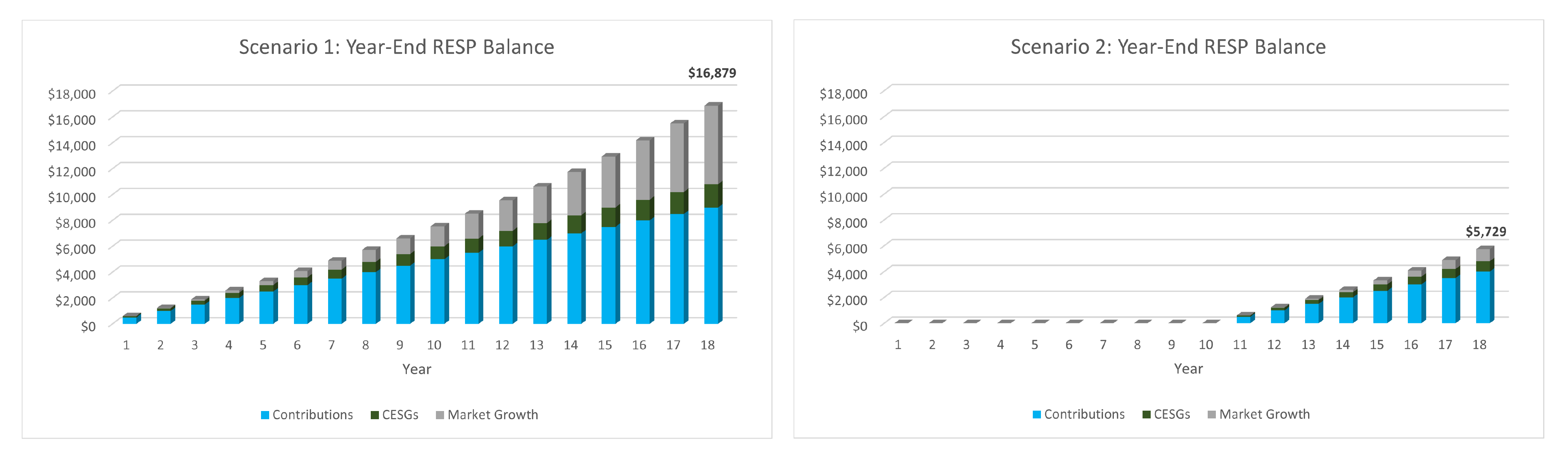

Scenario #1: Slow and steady. Virginia’s parents contribute $500 per year from when she is first born, for a total of $9,000 by the time she turns 18. This qualifies them to receive $1,800 in CESGs and assuming they achieve market growth of 5% per year[ii], that would add another $5,700 to the pot. The total value of the RESP at Virginia’s high school graduation would be greater than $16,500 – with more than 45% of it generated from grants and tax-free market growth.

Scenario #2: Start later. If her parents opt to leave it for now and revisit when she’s 10 – and then put in the same $500 per year – they’ll end up contributing $4,000 over those eight years. This would qualify them for only $800 of CESG, and with less time to compound, market growth would contribute only $900. This creates an ending value of approximately $5,700, with her parents putting in 70% of it.

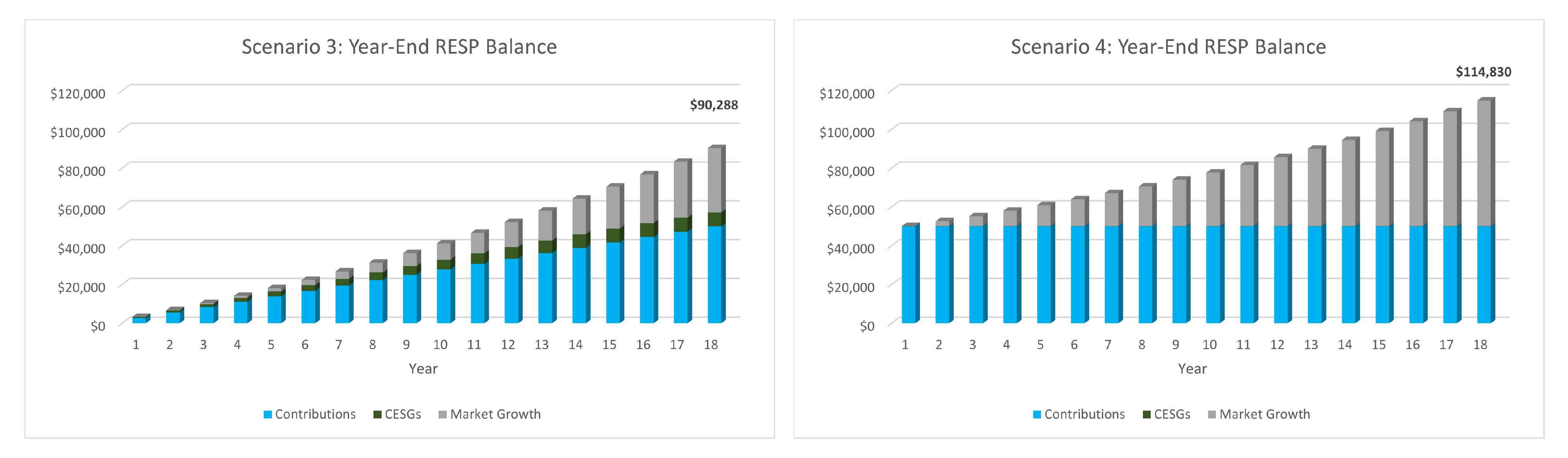

Scenario #3: Maximize over 18 years. If Virginia’s parents can swing a higher annual contribution, they should target hitting the $50,000 lifetime maximum, but in a way that ensures they maximize the CESG grants. This would mean putting in $2,778 every year until age 18. This approach would attract the maximum $7,200 in government grants and help generate about $33,000 of market growth. Virginia would have $90,000 for school, and $40,000 would have come from outside their family.

Scenario #4: Maximize everything in year 1. The grants are great, but to fully maximize the total potential balance at age 18, they should target hitting the $50,000 lifetime maximum in year 1. They’d only collect $500 in CESGs but the 18 years of tax-free market growth would yield a final balance of just shy of $115,000 – a bonus of $65,000 on their original payment.

What happens if the RESP expires?

We are often asked what would occur if the beneficiary does not enroll in post-secondary education, as some grads may take longer to decide their course of action or perhaps look to take off a gap year or two prior to attending school. Some will pursue other paths and never attend post-secondary. Will the RESP expire?

The answer is: eventually, yes. If so, your initial contributions are returned to you and any grant funds are returned to the government. You get to keep the market growth earned over the period, but it is considered what’s called an Accumulated Income Payment (AIP). When the funds are withdrawn, the AIP will be taxed at your personal income tax rate, plus an additional 20%. And you thought capital gains taxes were tough!

The good news is you do have some options to manage this risk:

You have time. An RESP can stay open for up to 35 years – and you can even contribute to it for 31 years – so your child has time to decide.

You can change the beneficiary of an RESP. This can be a good option for many families, though it’s important to be careful not to accidentally trigger a tax bill for over-contributing. If you change the beneficiary from Child A to Child B, the government considers all contributions to A’s account as a prior contribution to B’s account. There are some exceptions if B is under the age of 21 and shares a blood relationship with A, but best to get some advice before pursuing this tack.

You may be able to transfer RESP funds to another registered account. If you have contribution room you may be able to transfer up to a maximum of $50,000 of the income earned with the RESP to your or your spouse’s RRSP. This will continue to shield the gains from tax until you retire.

As is the case in all investing, starting early and contributing often is the best way to build your investment portfolio over time. With RESPs, the addition of government grants makes the case even more compelling. If you would like to discuss how to optimize your RESP account, please reach out to your Leith Wheeler portfolio manager, or email us at info@leithwheeler.com.

[i] You should also note that to receive the CESG when the beneficiary reaches ages of 16 and 17, one of the following conditions must have been previously met:

- At least $2,000 must have been contributed to, and not withdrawn from, an RESP for the beneficiary before the end of the calendar year the beneficiary turned 15; OR

- At least $100 must have been contributed to, and not withdrawn from, an RESP for the beneficiary in each of any four years before the end of the calendar year in which the beneficiary turned 15. [1] Any assumptions are for illustrative purposes only and are not a guarantee of future performance.

[ii] Any assumptions are for illustrative purposes only and are not a guarantee of future performance.

Recent Posts

- VIDEO: Navigating Dementia: Recognize, Prepare, Plan

- New Trust Reporting Requirements Now in Effect May Catch Some by Surprise

- Leith Wheeler Explainer Series: The Dividend Debate

- Hitting Pay Dirt: The Selling of an Ag Empire

- The Risks of Transactive Memory

- Building Out Your Core with US SMID and Emerging Markets Equities

- Resources for Reconciliation - 2023

- How Could Budget 2023’s Proposed Taxation of Donated Securities Affect Not-for-Profits?

- Taming an Unintentional Portfolio

- Women, Money, and My Holiday Beach Read