January 05, 2023

Balanced 3.0: Re-Engineering Your Portfolio For 2022+

The following article was first published in Benefits and Pensions Monitor's December 2022 issue (pp 17-18). It has been reprinted here with permission. You can download a PDF of the original article here.

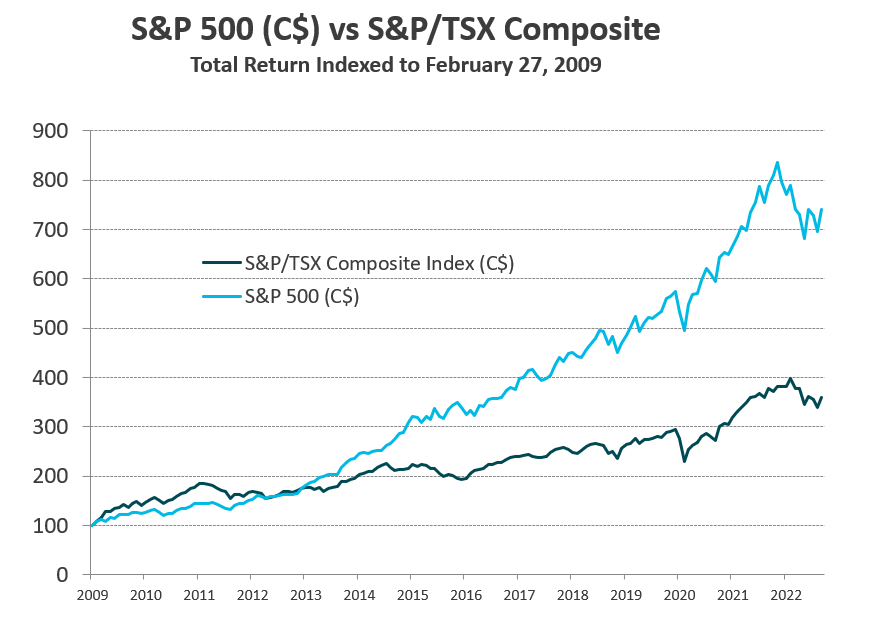

The decade that followed the 2008/09 global financial crisis proved very strong for financial assets, due primarily to very cheap money and many rounds of central bank easing. As Figure 1 shows, the S&P 500 increased by over eight times through its peak and the S&P/TSX by four.

Figure 1: US and Canada Stock Total Return from Market Bottom, February 27, 2009 (C$)

Source: Bloomberg.

The Fed’s approach of liberal quantitative easing and aggressively lowering rates has been the ‘every crisis’ hammer that central banks have used over the last 20+ years and, in recent years, has been akin to throwing gas on the already roaring fire.

Signs of Excess

Many investors appear to have assumed this massive support might never stop, which led to unprecedented risk taking and atmospheric valuations. This was especially true for growth investors who priced tech stocks as though the huge pandemic-driven pull-forward of demand would last a very long time. It didn’t.

In addition, the Fed fuel indiscriminately dowsed all companies, whether good or bad, making price discovery (i.e., active management) and price discipline a Herculean task. The cycle of ever-upward-spiraling gains, risk-taking, and hubris (interrupted very briefly in spring 2020) was the party that never stopped – until inflation came knocking. That has all changed now, so what should we do?

Balanced 3.0

In 2019, we did some work on what we called a ‘Balanced 2.0’ asset mix where we outlined principles like diversification, not-overpaying for expected alpha, increasing illiquidity only when rewarded, avoiding over complexity, having clarity on alignment issues, and more. These principles still apply, but the context has shifted enormously, so applying them today to a blank-sheet asset allocation exercise would not likely result in the same decisions.

We are suggesting that some portfolio decisions made over the last 12 years, and certainly the last six, should be revisited given the enormous change in forward market expectations.

The biggest change is that bond yields are more than double a year ago and look poised to provide a real return. Also, easing of pension solvency requirements means paying a big premium for private assets just to avoid mark-to-market no longer makes sense. Financing costs for debt are much higher, there continue to be supply issues, and labour markets are tight. Near-term inflation is at multi-decade highs.

The following sections highlight current characteristics of a few key asset classes, to help level-set expectations and thinking within the new reality:

Equity Markets Offer Select Opportunities. From 2009 to 2020, the fast growing-yet-expensive companies had their longest run in history – so strong that a few years ago the industry was awash with chimes of ‘value is dead.’ With growth’s tumble those refrains have changed, discordant as they are to the ears of investors in the FAANGS (Meta, formerly Facebook; Amazon; Apple; Netflix; and Alphabet, formerly Google) which, with the exception of Apple, are down between 30 per cent and 70 per cent year-to-date, as of writing.

This value rebound is just over two years old versus the average historic run of seven years and with valuations still stretched between growth and value, there remains a five to six times multiple gap on forward price/earnings, even after growth’s gross underperformance – and it looks like there’s more to go.

Also, what is described above is an opportunity-rich environment for stock picking – meaning active strategies should be better positioned to outperform than they have been for a long time.

Fixed Income at Four Per Cent ‒ A Viable Source of Return? It’s probably time to check in on the reasoning behind your fixed income allocation. For many years, anemic yields meant bonds were there mostly for the important risk-mitigating task of shock absorption. But with yields up considerably, bonds represent a viable return source for the first time in a long time.

Real (Private) Assets Require Closer Scrutiny. Given liquid bonds are yielding nearly four per cent, if you added a safe, core asset to replace low-yielding bonds in recent years that was expected to return say five per cent to seven per cent, is that now enough to compensate for the illiquidity, complexity, and fee increase? The hurdle rate for inclusion has clearly changed.

‘Added-value’ private assets targeted to exceed those safe, core asset returns could still generate returns sufficiently above bond yields, depending on the quality of the manager. Of course, debt costs have risen so their expected returns and especially their leverage need to be evaluated again. In fact, a disciplined and patient added-value real assets buyer could get some great bargains now.

What about inflation? Real assets clearly provide inflation protection. However, markets are telling us they expect long-term inflation to remain around two per cent, which is roughly in line with recent years. In addition, there is often a lag in those assets catching up to hot inflation, so they best serve to protect against sustained elevated inflation, not as much the short spikes we see today. Of course, a period of stagflation (low growth, high inflation) would mean real assets would benefit portfolios.

There is an ongoing repricing of risk across assets, strategies, and styles. As Antti Ilmanen, of AQR, has said: “Good returns require not only good strategies; they require good investors.” That means an even temperament, the ability to remain rational through all sorts of markets, and a willingness to continually test your existing views and revisit your past decisions. Now is not a bad time to consider this advice.

Recent Posts

- VIDEO: Navigating Dementia: Recognize, Prepare, Plan

- New Trust Reporting Requirements Now in Effect May Catch Some by Surprise

- Leith Wheeler Explainer Series: The Dividend Debate

- Hitting Pay Dirt: The Selling of an Ag Empire

- The Risks of Transactive Memory

- Building Out Your Core with US SMID and Emerging Markets Equities

- Resources for Reconciliation - 2023

- How Could Budget 2023’s Proposed Taxation of Donated Securities Affect Not-for-Profits?

- Taming an Unintentional Portfolio

- Women, Money, and My Holiday Beach Read